MicroStrategy Buys the Dip - Again!

MicroStrategy has bought another 3,900 BTC and is as committed as never before

Hey DEFI TIMES community,

Michael Saylor is probably Bitcoin’s biggest supporter. MicroStrategy was the first publicly-traded company to ever invest a significant portion of its treasury in Bitcoin.

In late 2020, MicroStrategy basically bought bitcoin on a weekly basis - making headlines and buying their way to become a legendary company.

Surprisingly, MicroStrategy has been quiet lately. But this week, Michael Saylor announced on Twitter that MicroStrategy has bought an additional 3,900 bitcoin - for a combined of $177 million!

As of today, MicroStrategy holds more than 108,900 bitcoin on its balance sheet.

To put it into perspective: MicroStrategy owns more than twice as many BTC as any other publicly traded company in the world. After MicroStrategy comes Tesla, which holds a little over 40,000 - as rumors suggest!

One thing is extremely interesting to observe: MicroStrategy has invested approximately $2.9 billion into BTC.

Right now, their holdings are worth $5.1 billion!

That means MicroStrategy’s Bitcoin investments made them more than $2.2 billion in total! Think about that for a second. The company started buying bitcoin only one year ago!

What a crazy journey!

That shows once again what one year in crypto can do to your business.

At this point, MicroStrategy has become a legendary business. MicroStrategy stock is basically a bet on Bitcoin with a much lower downside risk than Bitcoin itself. While most of MicroStrategy’s assets are stored in Bitcoin, they still have a running software business - which is profitable!

That means, even if their BTC investments go to zero, your investment in MicroStrategy equity won’t go to zero as well.

The MicroStrategy stock is a way for conservative investors to get indirect exposure to Bitcoin.

For me, it’s amazing to see how far Michael Saylor has come after one year of investing in Bitcoin.

Michael Saylor’s success speaks for itself. Money talks!

And one thing is very clear: The trend of publicly traded companies investing in Bitcoin is definitely not over yet!

Subscribe to our newsletter to level up your crypto game!

BENQI hits $1b in TVL

BENQI, a money market protocol on Avalanche, has hit $1b in TVL after the recent liquidity mining incentive program was announced.

VISA bought a CryptoPunk

As part of their historic commerce artifact collection, VISA has bought a CryptoPunk. NFTs are truly on fire!

Optimism Custom Bridge

Any ERC-20 token will now be supported on the Optimism bridge.

ENS <> DNS

ENS now supports DNS namespace on Ethereum.

Hop Bridges Optimism

Hop Protocol has integrated a bridge from Ethereum to Optimism. The L2 ecosystem is expanding!

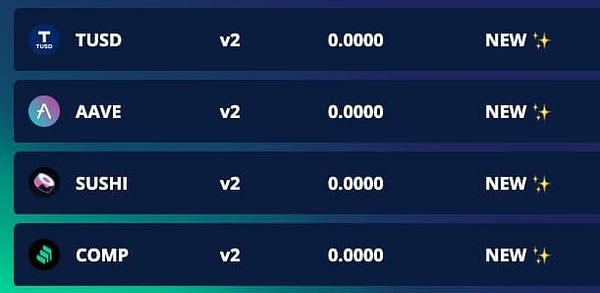

YFI adds four new vaults

Yearn Finance has added 4 new yVaults: TUSD, AAVE, SUSHI, and COMP.

Lyra on Optimism

Lyra, which is an optional protocol, has launched on Optimism mainnet.

Avalanche <> Ethereum

The Avalanche bridge now supports USDC. The trend is clear: The future will be interoperable.

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.