Will the Ethereum Merger Happen in 2021?

Why Ethereum will switch to Proof-of-Stake (PoS) in 2021 - ETH 2.0 merger

Hey DEFI TIMES community,

The Ethereum merger is expected to take place in 2021. And now, it seems like we have a potential date for the hard fork: October 2021!

Everything is happening faster than expected! Why? The miner strike could be one reason! Miners have too much power even though we are trying to abolish them. Ethereum is switching to PoS in October: The merger!

But not so fast! We need to tackle a lot of problems before we finally merge the Ethereum main chain with the Beacon chain! The miners are just one of them!

This article is about the consequences and the problems occurring when Ethereum switches from Proof-of-Work to Proof-of-Stake!

What can we expect in October? Why do we need to rush?

Let's dive straight into it!

Subscribe to our newsletter to level up your crypto game!

The Miner Revolt

Ethereum will not stay with Proof-of-Work (PoW) forever. From the very beginning, the plan was to eventually switch the consensus algorithm to Proof-of-Stake (PoS). This has several advantages; for example, it brings instant finality, and we can add sharding to the blockchain: splitting Ethereum into 60 different shards - all connected by the Beacon Chain.

Even though this update will be net positive for the Ethereum ecosystem, it comes with its own trade-offs. One trade-off is that a certain group of people will become obsolete: miners. As of today, miners secure the blockchain. They earn block rewards and transaction fees as compensation for their computing power.

Of course, miners knew from day one that their days were numbered; it was only a matter of time until Ethereum moved away from PoW. They stayed anyway to make money off Ethereum as long as there was money to be made.

And then DeFi summer happened - DeFi was in high demand, and block space became extremely valuable, which means that transaction fees got really high. Mining on Ethereum became lucrative again - at least in the short term.

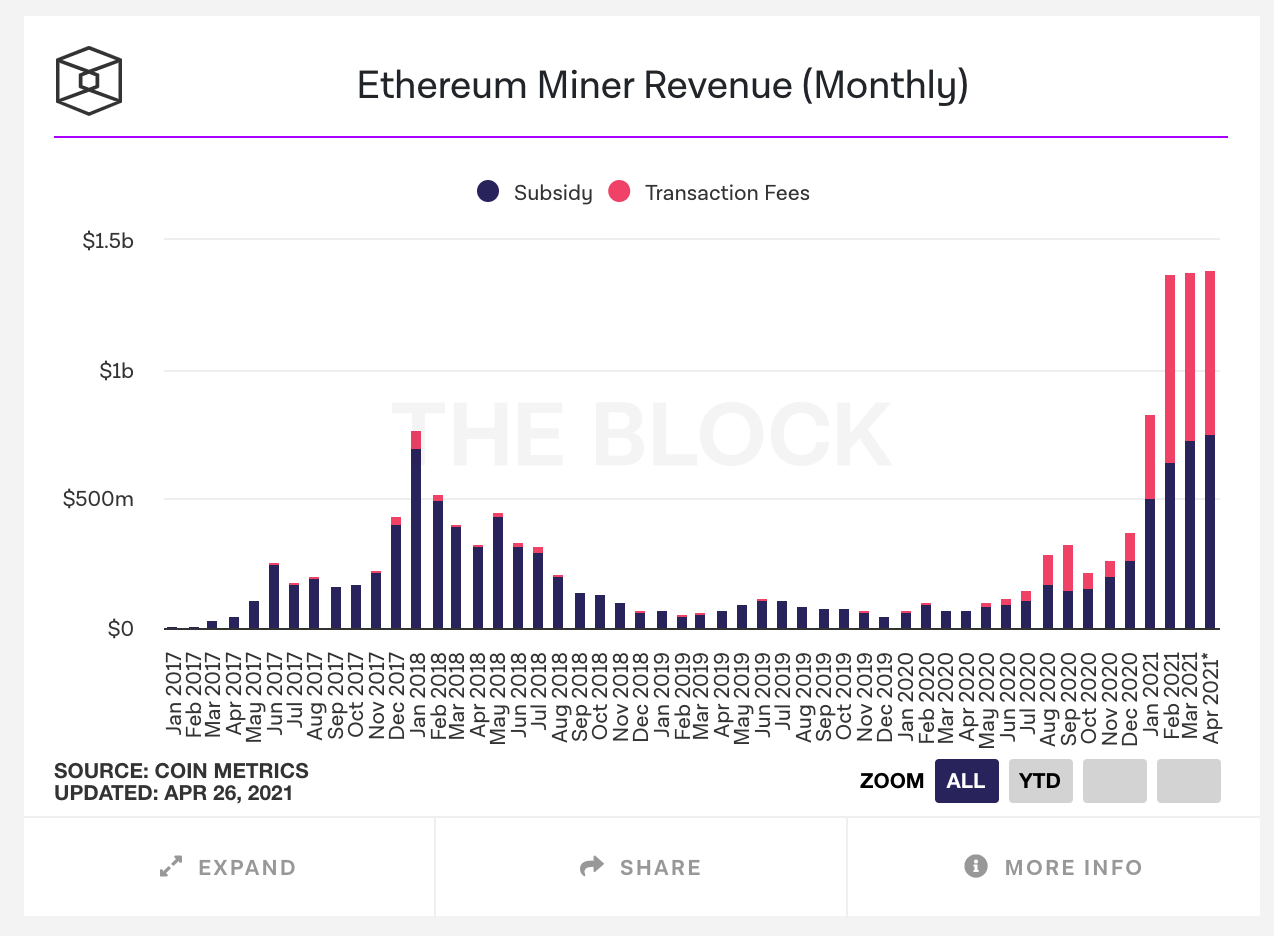

Today, transaction fees make up almost half of the miner revenue. That's why Ethereum's hash rate increased despite Ethereum's plans to transition to PoS in the near future.

More and more miners started to mine Ethereum blocks again, and then… EIP-1559 became a reality.

EIP-1559 will launch in July. This new Ethereum proposal will burn most transaction fees, taking away half the revenues from the miners.

That's why miners are in a pretty bad situation right now. PoW will be gone soon, and in the short time when they will still be able to mine Ethereum blocks, half of their revenue will be gone. I guess you can imagine that miners didn't like that… at all!

That's when things got messy. Of course, miners were strictly against EIP-1559 and came up with all kinds of reasons why this new Ethereum proposal will threaten Ethereum's security. They tried to use their power to convince the community not to implement EIP-1559.

But all the effort was pointless; EIP-1559 was here to stay. However, miners tried everything they could to avoid it. For example, miners agreed to conduct a 51% attack on April 1, 2021 - just to show off their power.

After it became clear that EIP-1559 would inevitably launch, miners tried one last time to save their revenue: EIP-3368. This Ethereum proposal was designed by miners with the ultimate goal to increase block rewards to 3 ETH per block. The proposal says that Ethereum's security could become weak when enough miners move away in preparation for Ethereum 2.0.

Shortly after this proposal was released, Tim Beiko stated that it indeed won't be implemented in the July hard fork. The miner's last hope was gone!

But one thing remained: the great tension between the Ethereum community and the miners. The community wants ETH to become the best store of value in the world; miners just want to make short-term profits. That's why the community realized that miners are becoming a significant threat to the Ethereum ecosystem.

They threatened to conduct a 51% attack once; why not do it a second time? And the scary part is: When time goes by, and there are only a few days left of PoW… the incentive to harm the Ethereum blockchain is high.

In the end, Ethereum took away the miner's profits. Why not go for revenge?

Miners became too big of a threat - and developers agreed to get rid of them… quickly!

The plan was clear: Move away from PoW as soon as possible!

Ready… Set… Go!

The Hackathon

Developers needed to address this problem as quickly as possible - and the best way to do so was to merge the Ethereum blockchain with the existing Beacon Chain.

The Beacon Chain is the initial version of the Ethereum PoS blockchain but with minimal functionalities. For example, no transfers are possible! The upgrade would essentially merge the existing Ethereum PoW blockchain with the Beacon Chain.

PoW → PoS

The transition from PoW to PoS will make miners obsolete because the blockchain doesn't rely on computing power to be secured. Stakers validate blocks and put their wealth at risk to stay honest participants.

That won't be the final version of Ethereum because we need one more piece of the puzzle: Sharding - splitting the blockchain into many parts to increase storage capacity! Sharding will take some time, but the merger could potentially happen this year. And it was all accelerated by the miner strike.

Developers want to eliminate the dependency on miners. That's why they started a hackathon on April 16 to make the merger a reality.

The hackathon will last one month and will include a very important project to work on the merger: Rayonism.

Many teams will simultaneously work on the merger and sharding implementations. At the end of the hackathon, the projects will be presented to several judges, and the best ones will receive prizes. The total prize pool is up to $200,000.

On the official Rayonism.io website, we can see the roadmap for the hackathon:

April 16: ETHGlobal Scaling Hackathon starts

Mid April: Sharding minimal viable specs target (No Custody Game or Data Availability Sampling)

During hackathon:

develop merge functionality on top of participating Eth1 and Eth2 clients

develop sharding functionality on top of participating Eth2 clients, enable KZG in EVM on Eth1

Stretch goal: Initial L2, Optimism-Eth2 prototype

May 14: Hackathon ends

Post-hackathon: launch public trial testnet with Merge and Sharding

As of today, the hackathon is well underway, but we are yet to see results. The final results will be presented on May 14, when the hackathon ends. After that, testnets with merge and sharding implementations will be launched.

These are no official results and testnets, of course, but they are the first steps in the right direction: a scalable Ethereum!

In that sense, the miner revolt was actually a good thing: It accelerated ETH 2.0. Just after the miner risk became clear, we had another major reason to switch to PoS as soon as possible.

Just as high gas fees accelerated the rapid development of second-layer solutions like Optimism or Arbitrum, the miner risk contributed to the consensus that the merger should happen already in 2021.

Without the miner revolt, the merger would probably have happened in 2022 or even after that - but now, we have a reason to get it done asap. The miner strike was a net positive event; however, we still have a lot of work to do and many risks to cover.

The Hard Fork

When will the merger happen? Well, we already have the first estimates of when it will occur. According to Nevermind, an ETH client team, the merger is targeted for October 2021.

To be honest, October could be a bit too optimistic, but we have a target that brings some clarity into the timeline. To be realistic, I think we can expect the merger to happen in late Q4 2021 or in Q1 2022.

But how do we prepare for this event? The merger is by far the most important event that has ever happened in the Ethereum ecosystem - that's why we need to prepare for some risks and consequences along the way.

Let's explore them!

The Problem

We want to push the merger through in 2021 because we want to get rid of the miners; however, as long as PoW still exists, they keep their power - and that's a huge problem. They won't give away their power quite easily.

No single power shift in history went without a fight… and the miners will fight for sure!

There's one single problem we need to solve before safely switching to PoS: What happens when there are only a few days of PoW left? What will the miners do? Will they happily keep mining Ether until there are no more blocks left? Or will they maliciously attack the blockchain to get revenge?

Think about it. When there are two months of PoW left, miners will probably keep mining ETH to pay their bills. But the moment when only a few more minutes of PoW is left is when miners have the greatest power and the least to lose.

It's not guaranteed that they will exploit their power. But we cannot rule out a malicious 51% attack either.

This is the uncertainty we need to live with while switching to PoS! Some people already thought of possible solutions to this problem. But none of them seem to work.

One possible solution is that we agree on a hard fork date and ultimately do the hard fork way earlier than expected. In theory, this one works really well, but how do you make sure that the miners won't find out? They will!

In the end, we have to trust that they will voluntarily give up their power - miners knew about PoS all along.

Conclusion

Will we switch to PoS in 2021? - Yes

Will there be risks? - Yes

It's not all that clear how we will eliminate the risk of a 51% attack just before the merger.

It all started with the miner revolt in early 2021. EIP-1559 will take away their profits once implemented. That was the point when miners showed that they disagree with where things are heading.

Then ETH developers decided that it was time to get rid of them. While the story's outcome is yet to turn out, one thing is certain: 2021 is going to be wild!

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.