Whales Are Selling Their ETH?! - MONDAY ON-CHAIN

Hey DEFI TIMES community,

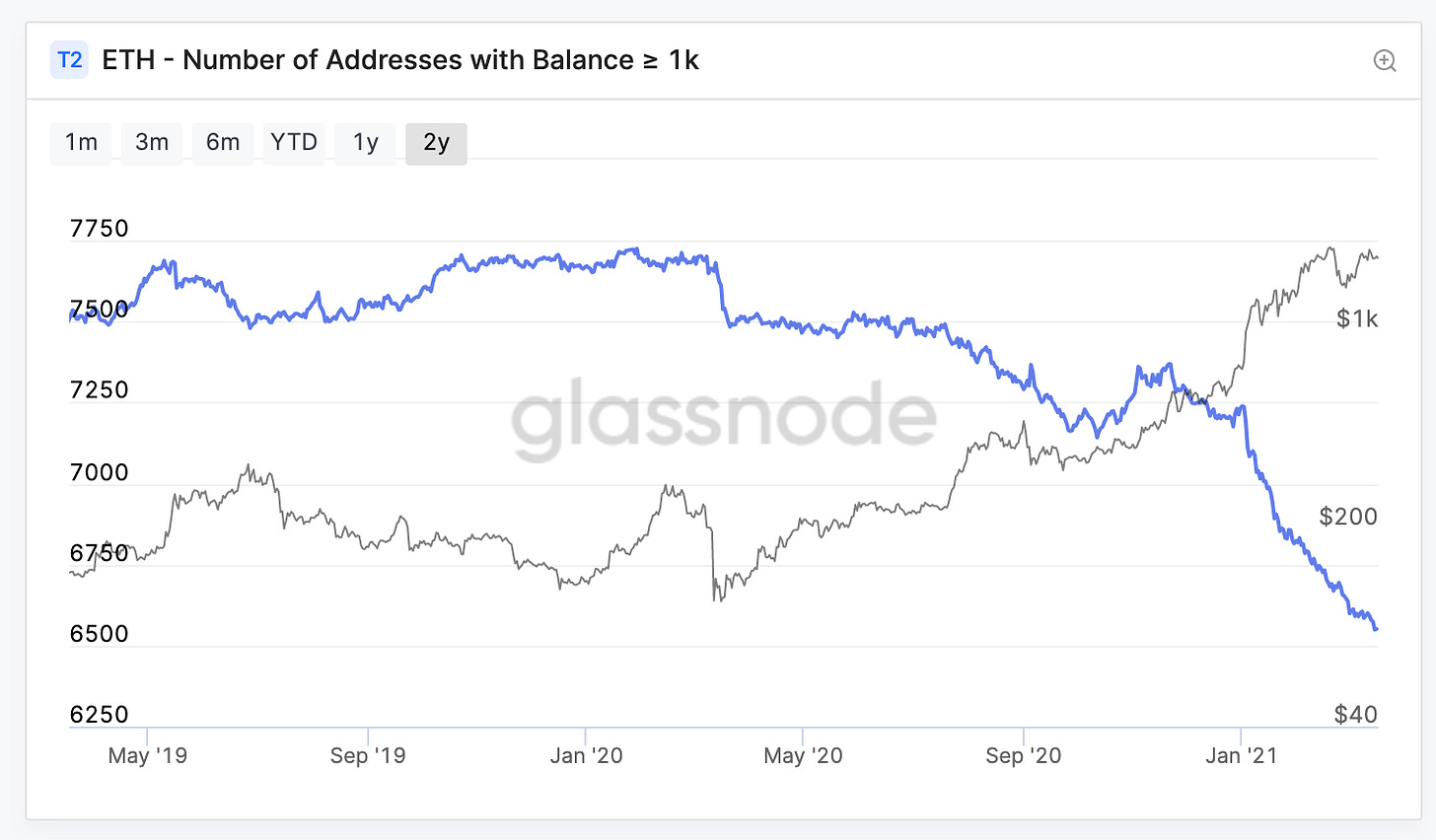

The number of addresses holding 1,000 or more ETH has been steadily declining over the past months.

After reaching almost 7,700 addresses in February 2020, the trend has been reversed - to the downside! It seems like the Corona crash in March was the catalyst! Since then, price and the number of addresses have been negatively correlated: The stronger the price increased, the more whales decided to move their ETH!

What's the reason for this trend? At first sight, there is no explanation: We are in a bull market! Why should whales sell?

It's not all that easy to answer this question because whales seem to be the main drivers of this bull run. If whales are selling, who is even buying?

In this article, I try to answer these questions from several perspectives.

The fact that fewer addresses hold more than 1,000 ETH might not mean...that whales are selling!

In fact, there might be good reasons for that! Let's explore them!

Subscribe to our newsletter to level up your crypto game!

What's happening?

The number of addresses holding 1,000 or more ETH has been steadily declining, but does this really mean that whales are selling?

It could be - but it doesn't have to! Technically, it solely means that ETH located on >1,000 addresses are being transferred to another (lower or higher level) address. And there are several reasons why ETH whales could do so. They could:

1) transfer their ETH to an exchange to sell

2) diversify their addresses

3) put their ETH to work in DeFi

Let's go through each of them!

Are whales selling?

Probably not! As you can see, most ETH is currently transferred off exchanges rather than on exchanges. We see a net outflow from exchanges to private addresses.

I know what you're thinking: What if all inflows come from whales and all outflows come from retailers? Well, that's a legit point - but is this really the case?

In my opinion, it's highly unlikely. To fact-check this claim, let's take a look at the number of addresses holding at least 10 ETH. In fact, this number has also been decreasing! So, we need to dig deeper!

There must be another reason for whale addresses declining over time!

Do they diversify their addresses?

Another reason for the declining whale addresses might be that whales diversify their ETH addresses. Have you ever been in a situation where you felt the need to diversify your crypto holdings over several addresses?

A simple example: Someone has $100 million worth of ETH on one single address. Even though it is improbable (close to impossible) for this address to be brute-forced, the person still feels the need to reallocate some funds to other addresses.

This theory would imply that people are diversifying their ETH across more addresses: They want to sleep well at night. They don't want to think about the worst-case scenario (Brute Force Attack) - even though it's almost impossible.

Of course, this action is not entirely rational, but it could help paranoid people!

And let's be honest: In crypto, only the paranoid survive!

Whales are putting their ETH to work

Another reason for declining ETH whales addresses could be that whales are depositing their ETH into smart contracts. They use DeFi protocols to earn a yield on their idle ETH.

In my opinion, this could be the best explanation because what else should whales do? Holding your ETH on an address is the equivalent of keeping cash under your mattress. It gets inflated away. At the moment, ETH has a decent inflation rate until EIP-1559 is here. Currently, the ETH inflation rate is 5-6% per year. So whales do have an incentive to fight against inflation, which means putting their ETH to work to earn yield!

Let's look at the facts: ETH locked in DeFi has been on a bull trend since early 2020.

Of course, you cannot simply conclude that all whales are locking their ETH in DeFi smart contracts; we don't have sufficient evidence; However, at this point, it is safe to say that whales are...not selling!

Conclusion

While it's safe to say that whales are not selling, it's not clear why whale addresses are declining. Whether they are irrationally diversifying across different addresses or depositing ETH into DeFi protocols is yet to be seen.

But the exchange inflows/outflows chart makes it pretty clear that ETH investors are taking their funds off exchanges - they are somehow hodling!

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.