The Bull Case for Ethereum - SUNDAY THOUGHTS

Listen to the audio version of this article!

Hey DEFI TIMES community,

I believe that ETH will perform exceptionally well in this bull market! Ethereum is the ultimate transaction layer for decentralized financial services. Currently, it has the most developers and capital; it is also the most battle-tested infrastructure.

Ethereum survived several attacks, and core developers are working hard to scale Ethereum to a globally accessible platform. Hundreds of successful DeFi applications have been built already. The number of developers joining the industry and learning Solidity is higher than ever before.

However, there are far more reasons why I believe ETH is going to stand out in 2021. Today, I would like to introduce three reasons why ETH is going to the moon in 2021.

Let's dive into it!

Subscribe to our newsletter to level up your crypto game!

Huge potential and price speculation

The potential market for ETH is tremendous. Ethereum has reached a product-market fit for replicating financial services, which means that any financial instrument can be built on the Ethereum blockchain.

The financial market is the biggest in the world. For example, the derivates market alone is estimated to be worth over $1 quadrillion dollars.

Imagine a world where Ethereum could capture only a fraction of the derivates market; let's say one percent. It would bring approximately $10 trillion of value to the Ethereum blockchain.

ETH is the native currency of the Ethereum network and is used as collateral for these derivates. ETH would need a $10 trillion market capitalization to cover the derivates market (100% collateralization ratio).

Under these circumstances, one Ether would be worth around $87,000. Now imagine what could happen if significant parts of the WHOLE financial system would be replicated on Ethereum!

Alright, let's get back to reality. ETH will certainly not hit $87,000 by 2021; it will probably not capture one percent of all derivates in the world. But I expect more and more financial products to be built on Ethereum in 2021.

Additionally, you have to consider that markets do not reflect current conditions. Markets tend to reflect future expectations.

If the market expects Ethereum to replicate a fraction of the global financial system, one Ether could potentially rise to $10,000 or even beyond that!

Institutions are here

It is nothing new that institutions are entering the crypto market. However, they buy significant amounts of bitcoin so far. I believe that institutions will get more exposure to ETH to diversify their positions in the crypto market.

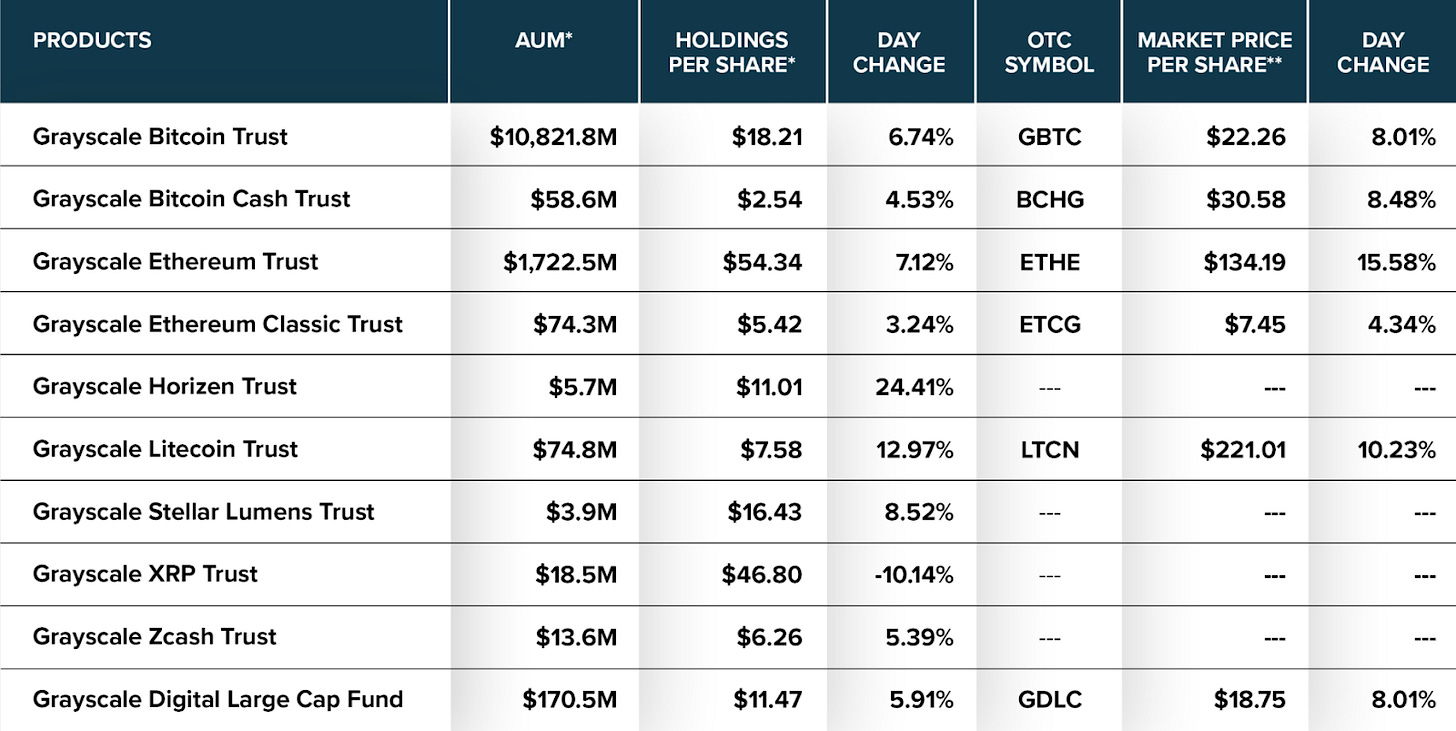

Let's take a look at Grayscale's crypto holdings.

Institutional investors using Grayscale's services are holding 1.7 billion dollars worth of ETH (December 15). Therefore, ETH is the second-largest institutional crypto holding.

But this is only the beginning. What do you think will happen when big institutions realize how slow the old financial system is and that there are far superior protocols on the Ethereum blockchain?

What will happen when they learn about Automated Market Markers, Lending Pools, and Yield Optimization protocols?

What will happen when they realize that ETH is designed to capture value as Ethereum is increasingly used?

Soon, institutions will understand that Ethereum is the financial infrastructure of the world. Ethereum is the beginning of the end of wall street.

2021 will be the year when the world will find out. Big money will flow in trustless assets like Bitcoin and ETH, and there is no way to stop that.

Transaction fees burning

EIP-1559 establishes a "market rate for block inclusion", eliminating the old auction system for transaction fees. Currently, there is no market price for transactions; If you pay the average gas price of the last hour, there is no guarantee that your transaction will be included in the next block. EIP-1559 will fix this by delivering a market price of transaction fees.

However, there is an even more exciting part of this proposal: EIP-1559 will also enable fee burning. Instead of paying out the miners' transaction fees (or stakers), the fees will be burnt. They are gone forever.

EIP-1559 will likely turn the ETH issuance negative because more ETH could be burnt than emitted.

This concept changes the tokenomics of ETH by 180 degrees. ETH will be the most scarce and trustless asset in the world. While Bitcoin relies on its inflation schedule to maintain the security of the network, Ethereum can keep the network safe while having negative issuance.

EIP-1559 potentially could make the ETH price skyrocket. If demand for ETH stays the same, the price of ETH will inevitably go up because the supply shrinks over time.

Transaction fee burning is the last piece of the puzzle why ETH is set for a parabolic bull run next year!

Conclusion

We have explored three different reasons why ETH will go parabolic in 2021.

The potential market for ETH is enormous because the financial market is the biggest in the world. If Ethereum could capture only a fraction of it, we will do tremendously well in 2021. On top of that, price speculation could drive the price even higher than the fair value because markets reflect future expectations.

Institutional investors will diversify their crypto portfolio even more in 2021, which could mean that they will position themselves heavily in ETH and DeFi. Just as Bitcoin profited from institutions in late 2020, ETH could profit from institutional money in 2021.

ETH fee burning is the final piece of the puzzle. As transaction fees are burnt, the issuance of the Ethereum network could become negative.

If you consider these factors, you realize why ETH is set for another parabolic bull cycle that will attract the whole world's attention.

All in all, we at DEFI TIMES believe that ETH could go as high as $12,000 by December 2021! What is your price prediction for ETH and other cryptocurrencies?

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.