Stable Interest Rates on the Blockchain - SmartCredit

Hey DEFI TIMES community,

Have you ever used lending protocols on the Ethereum blockchain? If the answer is yes, you probably noticed one problem stopping them from mass adoption: variable interest rates. When you borrow tokens from a lending pool like Compound, the interest rate is determined by supply and demand. Unfortunately for the borrower, the interest rate can change quickly to the upside if the token supply reduces.

This mechanism reduces the lending protocol's chances to achieve mass adoption because borrowers need more certainty about their loans. Imagine the following situation: you and your family want to get a mortgage for your house, but you can never be sure how the interest rates develop over time. Ordinary people will never use Ethereum protocols for big financial decisions if this problem doesn't go away.

We are in desperate need of fixed interest rates. Lately, we at DEFI TIMES were searching for projects that tackle this problem, and today we would like to introduce an excellent solution to you: SmartCredit.

SmartCredit solves this problem by providing fixed-rate lending for its users.

Let's dive deeper into it!

Subscribe to our newsletter to level up your crypto game!

How SmartCredit works

There are two main components of the SmartCredit ecosystem: Lending and Borrowing. In this review, we will explain in detail how you can use the SmartCredit platform for both options. In general, there are two tokens you can use at the moment: ETH and DAI.

Lending

In this review, we will focus on lending ETH, but the process is the same for both of them.

First of all, you have to register on the SmartCredit website as a new user. When you finished the process, create your profile and choose whether you want to borrow or lend. Choose "Lend", and you are good to go. You will also have to enter your ETH address in your profile. This is essential because the borrower will send the funds to this address on the maturity date. When you have done all those things, you are set for lending.

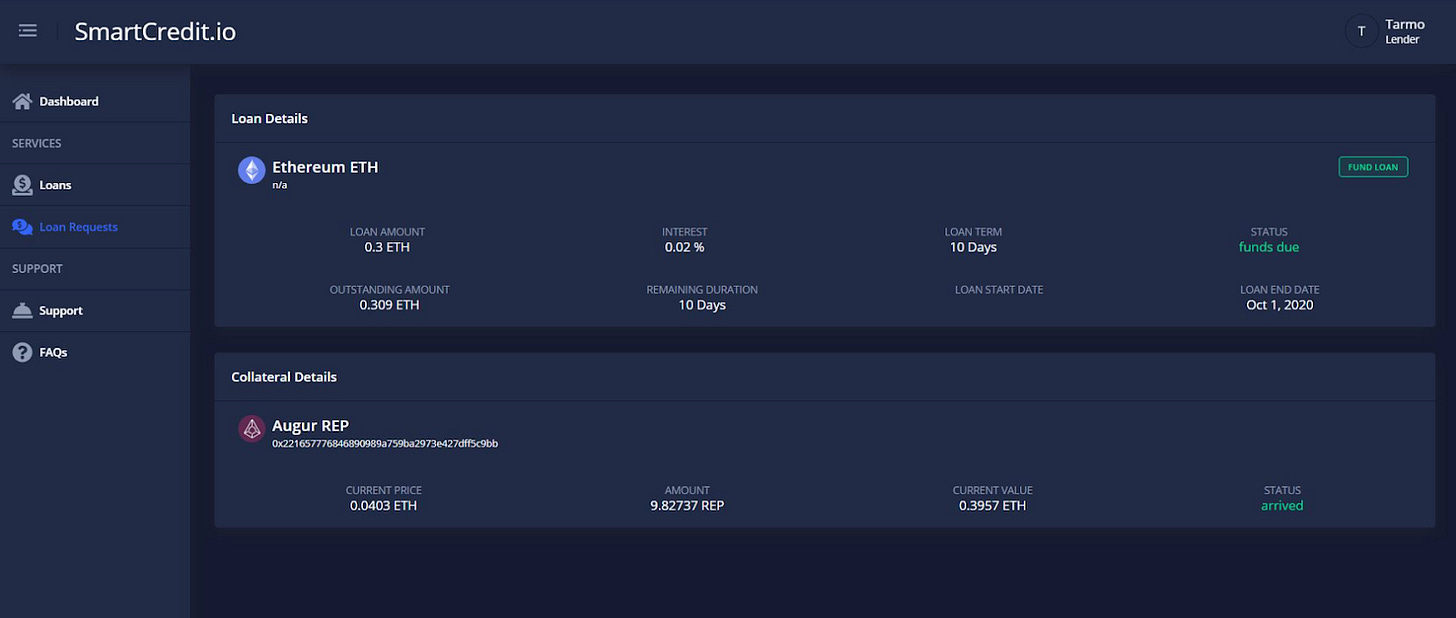

On the SmartCredit interface, click on "Loan Requests". There you will see all the available loans you could give out. Choose one and click on it.

On the following screen, you will see the relevant information to decide whether it is worth it to take the loan. You can check which type of collateral the borrower has used, how much ETH is required, how high the interest rate is, how long the duration is, and so on.

Let's assume that you decide to provide the necessary funds for the borrower. The process afterward is as quick as it can be. You click on "Fund Loan". A popup window will occur, with which you can confirm the transaction.

Congratulations, you just created your first loan with SmartCredit! In exchange for your lent out funds, you will receive ccETH, which is pegged 1:1 to ETH. You can even freely transfer it. The holder of ccETH will receive the assets on the maturity date.

Borrowing

As you probably noticed, you have to create a loan request to be eligible for receiving a loan in the first place. The process is relatively easy.

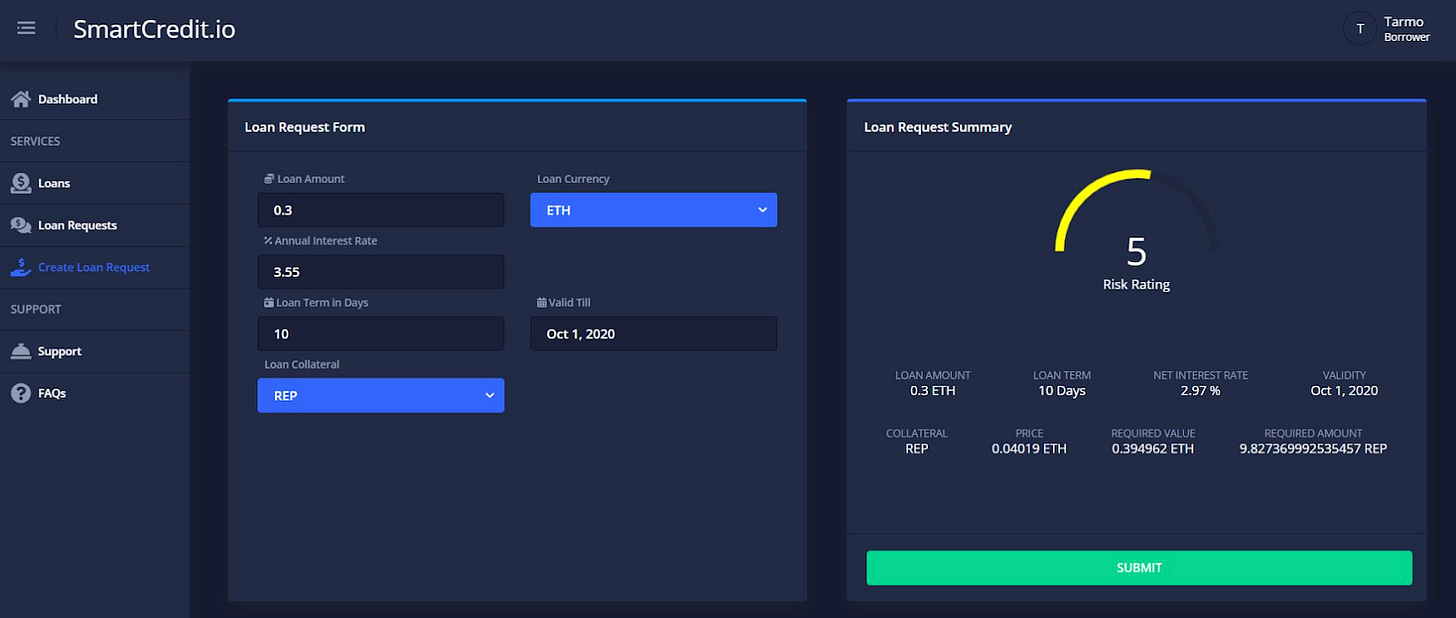

On the left screen side, click on "Create Loan Request".

There are six fields you need to fill out:

1) Loan Amount

2) Loan Currency

3) Annual interest rate in percent

4) Loan term in days

5) The date until the loan request is valid

6) Type of loan collateral

When you are done, click on "Submit". There is one last step to submit your first loan application successfully: providing collateral for the loan.

Click on "Confirm Transaction", and you are done. Now you only have to wait for a lender to approve your loan and provide funds. Of course, you will be notified via email when it finally happens.

Low collateral and set interest rates

On the SmartCredit platform, lenders and borrowers come together smoothly. That's how SmartCredit makes it possible to achieve stable interest rates in the lending process. It's also important to mention that SmartCredit enables a lower collateralization ratio than most other lending protocols. Overall, the lending experience is remarkable. We highly recommend you to check it out.

Tokenomics

The SMARTCREDIT token is the native token for the SmerCredit ecosystem. There are many use cases for it, but we would like to focus on seven important ones today:

SMARTCREDIT tokens will be...

1) ...used to pay for fees on the SmartCredit platform

2) ...collateral for borrowers

3) ...used to improve credit score for borrowers. The more you hold, the better your credit score.

4) ...governance tokens of the SmartCredit platform. The token holders are eligible to decide on crucial platform parameters.

5) ...rewarded to platform users and B2B partners

6) ...used for liquidity mining. You can earn SMARTCREDIT tokens by merely using the platform.

7) ...a marketing vehicle. The token will be used to pay for cooperations to grow the platform.

The tokenomics are designed to grow the ecosystem. Liquidity mining incentivizes participation, tokens are used to pay for business partners, and token holders can decide on the future of SmartCredit. Any token holder is highly encouraged to participate in the platform.

Conclusion

SmartCredit takes a different approach for lending than traditional lending protocols like Aave or Compound do. SmartCredit doesn't use a liquidity pool; it uses an order book like approach, where lenders can choose which borrower they want to lend money to. In this way, SmartCredit ensures that interest rates are stable so that users can plan their finances accordingly.

The user experience is effortless and smooth. The interface looks appealing and is in no way comparable to your traditional (ugly) online banking interface.

The tokenomics ensure the long term growth of the SmartCredit platform. Token holders are incentivized to participate in the ecosystem and hold the token.

All in all, SmartCredit seems attractive from an investment perspective. Before you invest in SMARTCREDIT token, please do your research; this is not financial advice.

Make sure to follow SmartCredit on Twitter and visit their website for further information.

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.