Polygon Ecosystem Map

An overview of the fastest growing ecosystem in Decentralized Finance

Hey DEFI TIMES community,

We’ve talked about Polygon many times in the past. It’s by far the fastest-growing ecosystem in DeFi right now. That’s why you should know about it!

The state of Polygon heavily reminds me of Ethereum in early 2020. An ecosystem of many promising applications that have the potential to take off. However, Polygon has one advantage making it even more attractive: it’s scalable, fast, and cheap!

That’s why Polygon is growing faster than Ethereum ever could.

At this point, it’s almost irresponsible to ignore Polygon’s ecosystem.

Missed Ethereum’s DeFi Summer 2020? - No worries, we have another one coming soon!

But this time, you are early!

So, let’s learn about the fastest-growing ecosystem in Decentralized Finance!

What are the biggest and most promising apps on Polygon?

How much value is locked?

How fast is Polygon expanding?

Subscribe to our newsletter to level up your crypto game!

Exploring the Polygon Ecosystem

Total Value Locked

Let’s start with the most important metric of them all: Total Value Locked! By checking Polygon’s TVL, we can directly derive the health of the Polygon ecosystem. Why?

By locking your assets, you trust a particular protocol with your capital. That means, the more trust people put in a protocol, the higher its TVL.

So let’s take a look at the aggregate TVL of Polygon-based apps!

Over $5.4 billion are locked in Polygon protocols.

As you can see, the trust people are putting in Polygon is at an all-time high. Polygon continues to stand out among all other blockchains, with numbers that reach higher highs every month. While the crypto industry has been crashings for weeks, Polygon enjoyed a bull run. This could be partially due to its popularity in India.

But probably the most important reason is Polygon's scalability. After Ethereum gas prices literally exploded, people were searching for cheaper alternatives.

One alternative is BSC. The problem with BSC is its centralized nature and its image as an Ethereum competitor. Polygon, on the other hand, doesn’t brand itself as an Ethereum competitor - but rather as a complement. Polygon managed to leverage Ehtereum’s network effect better than BSC ever could!

In addition to Polygon’s marketing strategy, it managed to attract a prominent investor: Mark Cuban. He invested big in MATIC in May 2021. That news alone sent the Matic token through the roof, jumping 40% in a day - also contributing to Polygon TVL’s growth in the last few weeks.

Top DApps on Polygon

As a smart contract platform, Polygon relies on an ecosystem of different protocols developing their own network effect. A healthy DApp ecosystem is crucial for Polygon’s survival and development in the long term.

So, let’s take a look at the top five protocols building on Polygon!

By far the largest protocol is Aave. Aave is a lending and borrowing platform, originally deployed on Ethereum. However, the protocol has a multi-chain strategy, which means that Aave will be represented on multiple blockchains, sidechains, and second layer solutions.

In addition, we have several other Ethereum based protocols: Curve and SushiSwap. Both are known to drive a similar multi-chain strategy as Aave.

QuickSwap is the largest exchange on Polygon - Polygon’s version of Uniswap if you will!

Network Stats

Network Utilization Chart

Apart from the TVL and DApp ecosystem, another important metric to explore the Polygon ecosystem is the network utilization chart.

The network utilization chart shows the average gas used over the gas limit in percentage. This chart basically tracks how full Polygon’s blocks are - meaning whether Polygon’s capacity is at its limit.

As you can see, Polygon’s blocks are currently close to 95% full. That means that Polygon is close to reaching its scalability limit. This is both good and bad.

It’s positive because it shows that Polygon has reached product-market fit. On the flip side, Polygon is close to reaching the same scalability limits as Ethereum (Relying on second layers and side chains to scale further).

Daily Transactions Chart

The main reason why the network utilization chart indicates full utilization is that transactions are increasing.

Right now, Polygon processes almost 7 million transactions on a daily basis. Just a few days ago, Polygon processed over 9 million transactions daily.

That’s multiple times more than Ethereum transactions - Ethereum processes only 1 million ETH transactions per day.

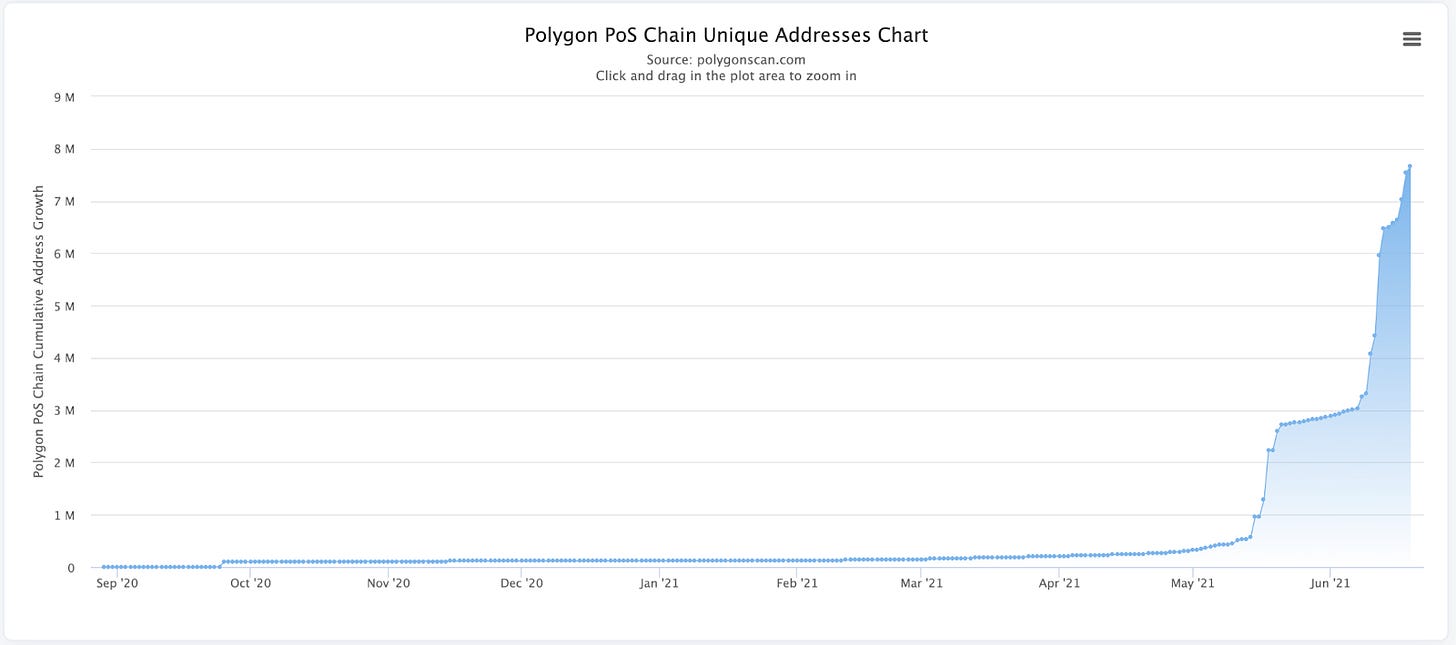

Unique Addresses Chart

Why is the number of transactions increasing? Well, because more and more users join the Polygon ecosystem.

As of today, there are close to 8 million unique addresses on Polygon. Of course, this doesn’t mean that Polygon has the equivalent number of unique users - people can have multiple accounts.

Conclusion

Polygon is growing - faster than ever. The key takeaways should are:

Over $5.4 billion are locked in Polygon protocols (TVL is at an all-time high)

More and more Ethereum based protocols are joining the Polygon ecosystem

Polygon’s capacity is close to its limit.

Daily transactions are increasing.

There are close to 8 million unique addresses on Polygon

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.