OctoFi - DeFi for Everyone

Introduction

Most DeFi protocols are too hard to use for ordinary people. Imagine your aunt using Uniswap when she doesn’t even know how to use her iPhone properly.

To scale the crypto industry to mass adoption, we need simpler user experiences. That’s why it is so crucial to simplify user interfaces to the absolute minimum.

Even your grandpa should be able to understand how to swap tokens on Uniswap, how his portfolio performs, and how to discover new DeFi opportunities. This is not the case today, as using DeFi products requires hours and hours of learning, grinding, and trying out new things.

OctFi changes this situation for the better because it provides a simple user interface (even your grandpa gets it).

But OctoFi isn’t only about improving the DeFi user experience. Let’s dive deeper into it!

Level up your DeFi knowledge and subscribe to our newsletter!

How OctoFi works

Aquafarm

Aquafarm is the only platform you need when it comes to DeFi investments. There are eight core features of Aquafarm, which make it unique:

1. Dashboard

When you log into Aquafarm using your Ledger, Metamask, or any other wallet, you see a Dashboard, which looks like this:

The dashboard is a simple interface, which gives you an overview of your portfolio performance and asset allocation. These kinds of dashboards are extraordinarily helpful for DeFi investors. How many times did you provide liquidity to a protocol and forgot about it? With Aquafarm this will never happen to you because it knows better where your assets are than you do.

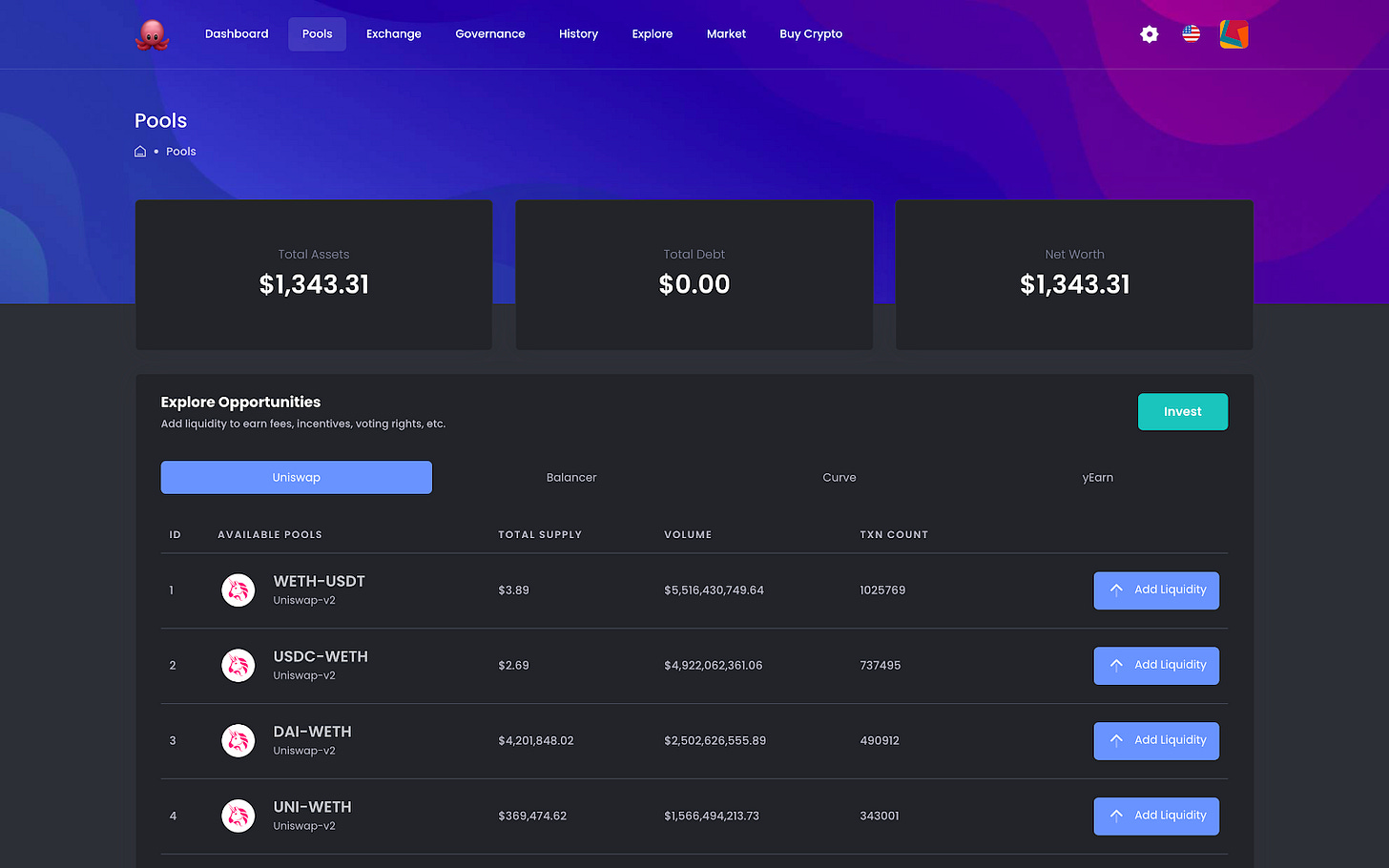

2. Pools

The invest function helps you discover DeFi opportunities like brand new liquidity pools. You can also add pools to the list if your favorite one isn’t included yet. There are thousands of pools already showing from Uniswap, Balancer, Curve, and yEarn.

3. Exchange

The exchange tab lets you easily exchange tokens on the OctoFi platform. Because OctoFi integrated Uniswap, you can swap almost any ERC-20 token available. Try it out as long as gas prices are low.

A lot of other features will be integrated in the future. Exciting times ahead!

4. Governance

OctoFi also includes a community-owned governance platform as part of an integration with Snapshot. Active OCTO token holders can visit this webpage to create and vote for governance proposals. The page looks like this:

As you can see, there are many proposals already, all aiming to improve the OctoFi ecosystem. If your request gets accepted and you do valuable work for the protocol, you get rewarded by the treasury fund.

Here’s how you can create a new proposal:

1. Visit dao.octo.fi

2. Connect your Metamask wallet, where you hold $OCTO

3. Click on “New Proposal”

4. Fill out everything that is required to publish the proposal

5. Be creative and include as many details as possible (this is important as it raises your chances to receive funding)

6. Go to the “Actions box”

7. Select start date

8. Select end date

9. Fill out the snapshot block number (read more about it here)

10. Publish the proposal and sign the message using your wallet

This is how easy it is to create a new proposal for the OCTO community. Try it out yourself!

5. History

The history tab gives you a simple overview of all transactions for your address, complete with reference links to etherscan, and the ability to export to CSV.

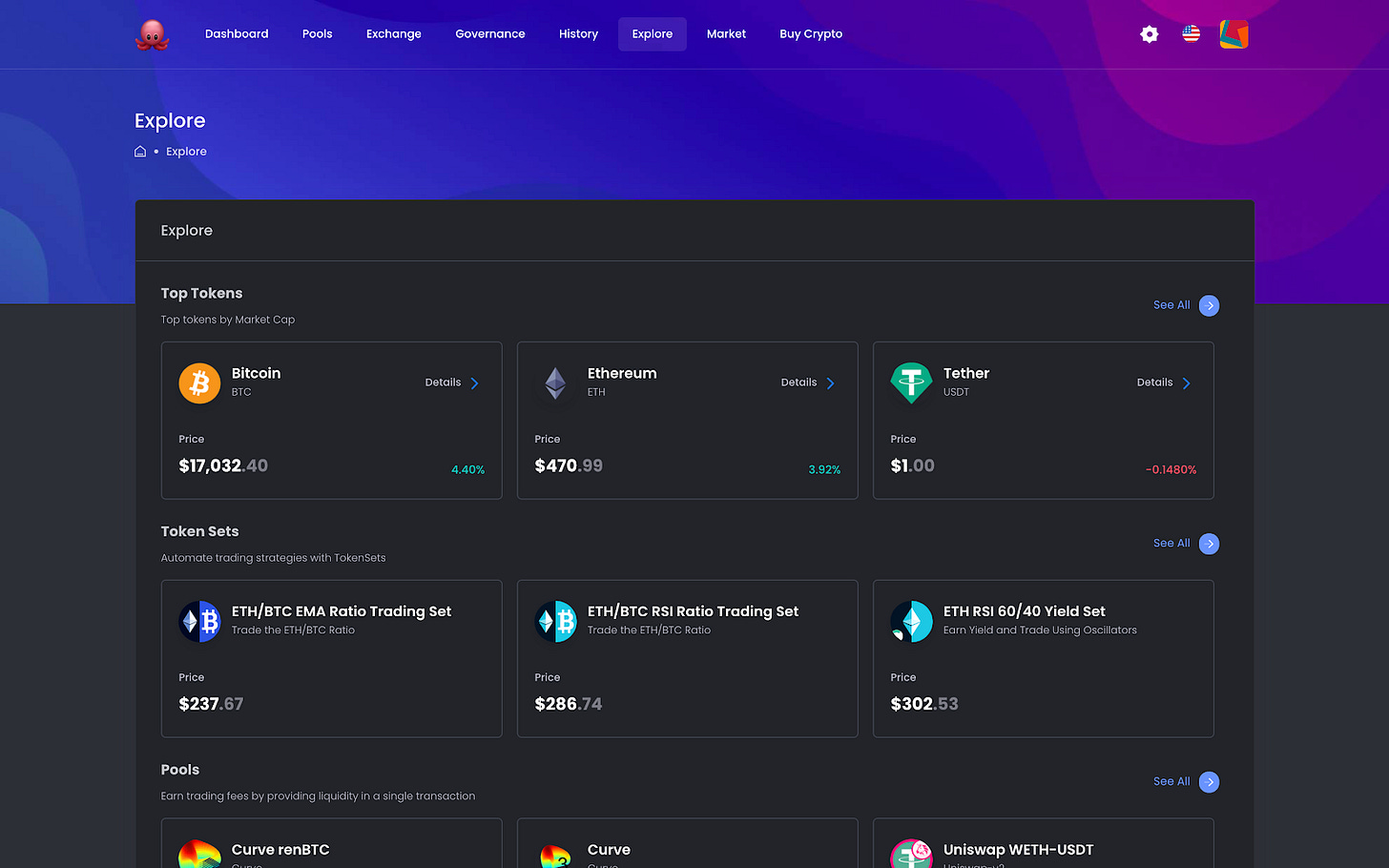

6. Explore

When looking to discover new investment opportunities, the Explore tab is the place to be. You can scroll through the top tokens, pools, token sets, see what’s trending on CoinGecko and the top gainers and losers. Simply work your way through the list and swipe the cards left and right to view additional options.

7. Market

The market tab pulls in data on over 6,000 crypto assets, all of which you can click through to detailed charts and market data. This section is also home to the tentacles beta, where pricing data for selected assets is aggregated from multiple oracles. You might be surprised to see the variance across different source, but more on that later.

When you click through to individual assets you can view much more detailed information, and even click through directly to buy and sell.

8. Buy Crypto

For those who are new to DeFi and don’t necessarily have the funds they need to invest, there’s a fiat gateway included. Users can buy crypto directly from within the dashboard for those times when they need to get some more fiat into their crypto wallet.

Tentacles

Another goal of OctoFi is to build trustworthy Oracles for the DeFi ecosystem. Today, most protocols still rely on single data oracles and pretend they are completely decentralized. With Tentacles, OctoFi will build incentivized oracles aggregators that are being kept honest by the community. This will be built as a side project to benefit their own infrastructure.

Updates and Roadmap

Q4 2020

November

In November, Lending and Borrowing through Aave/Compound will be integrated into the Dashboards. Also, some more Aquafarm updates regarding TokenSets, Snapshot.Page aggregation, oracle beta will be released.

December

In December, OctoFi’s native CEX competitor will be launched (the protocol’s native DEX), which will be as easily usable as any DEX you can think of. You will be able to trade on a basic and advanced level (derivates trading, market maker functionality). There’s also the possibility of adding new tokens via kleros.io. You will even be able to trade NFTs on the exchange!

Q1 2021

January

January is going to be a huge month for all OCTO holders. From then on, trading fees will be distributed to OCTO token holders, turning $OCTO into a capital asset. Furthermore, cross-chain swaps will be implemented, connecting OctoFi to Bitcoin, TRON, and EOS.

Exciting times ahead if you are part of the community!

Tokenomics

The token distribution of $OCTO is relatively simple. There’s a total supply of 800,000 $OCTO, which are distributed in the following ways:

Locked Supply 225,129 OCTO (Reserve 200,000 tokens; Liquidity 25,129 tokens)

Circulating Supply 311,748 OCTO

At first, $OCTO serves only as a governance token, giving holders the right to participate in key protocol parameter decisions. Beginning in January 2021, $OCTO holders will profit from actual usage of the platform because they will receive the protocol fees.

Here are some more features of $OCTO:

- Will unlock exclusive advanced features (as tested with temporary full Aquafarm restriction)

- Will be able to claim their respective share of trading fees on the platform with ALL trading fees/revenue in distributed in ETH

- Will direct platform decisions via governance

- Won’t need to pay fees for trading

Conclusion

OctoFi is a brand new DeFi project that could potentially help to bring DeFi to the masses. Its dashboard makes Decentralized Finance appear simpler than logging into your online banking account.

You can do almost anything you genuinely need for your finances with this dashboard. You can invest, discover, swap, track, and so much more to come in the future.

The new token model of $OCTO, which will go live in January 2021, will turn $OCTO into a capital asset, allowing holders to profit from user adoption. Similar to the token model of Kyber Network, users will earn protocol fees.

Whether or not $OCTO is something you should invest in is totally up to you. However, we believe that OctoFi adds real value to the DeFi space.

For more information, check out their website and join their Telegram group.

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.