NOTIONAL FINANCE - Fixed Rate Lending on Ethereum

Introduction

If you want to lend your tokens on the Ethereum blockchain, you will only be able to do variable rate lending on most protocols. The interest rate is usually determined through supply and demand of the token. When the demand rises, the interest rates go up. When the token supply increases, the interest rate goes down.

This mechanism is a pity for borrowers as they need to have certainty about the costs of borrowing. Imagine a situation where you want to borrow money to buy a house. You have a safe job, but only a limited amount of money every month. That’s why you want to make sure that you will cover the interest rates before taking the loan.

This dilemma produces the need for fixed-rate/term lending, where borrowers and lenders agree on a fixed rate of interest. Unfortunately, most lending protocols on Ethereum lack this feature. They cannot serve as a stable source of credit.

Notional Finance solves this problem by providing fixed-rate lending for its users. Let’s dive deeper into it!

Level up your DeFi knowledge! Subscribe to the newsletter now!

How Notional Finance works

fCash

fCash tokens are the fundamental building blocks of the Notional Finance ecosystem. There are two types of fCash:

1. Positive fCash balances

These are assets that can be redeemed for currency at maturity.

2. Negative fCash balances

Negative fCash balances are obligations or debt, where the owner has to provide a unit of currency at maturity.

fCash balances, therefore, represent debt or assets depending on whether users want to borrow or lend money.

Liquidity Pools

Notional makes fCash available to trade within its native AMM-enabled liquidity pools. A Notional liquidity pool holds fCash alongside its currency type (Dai and fDai for example). A liquidity pool refers to a maturity - A Dec 1 2020 liquidity pool holds Dec 1 2020 fCash.

Maturities

The maturities are based on a set interval depending on the key governance parameters.

Users Base

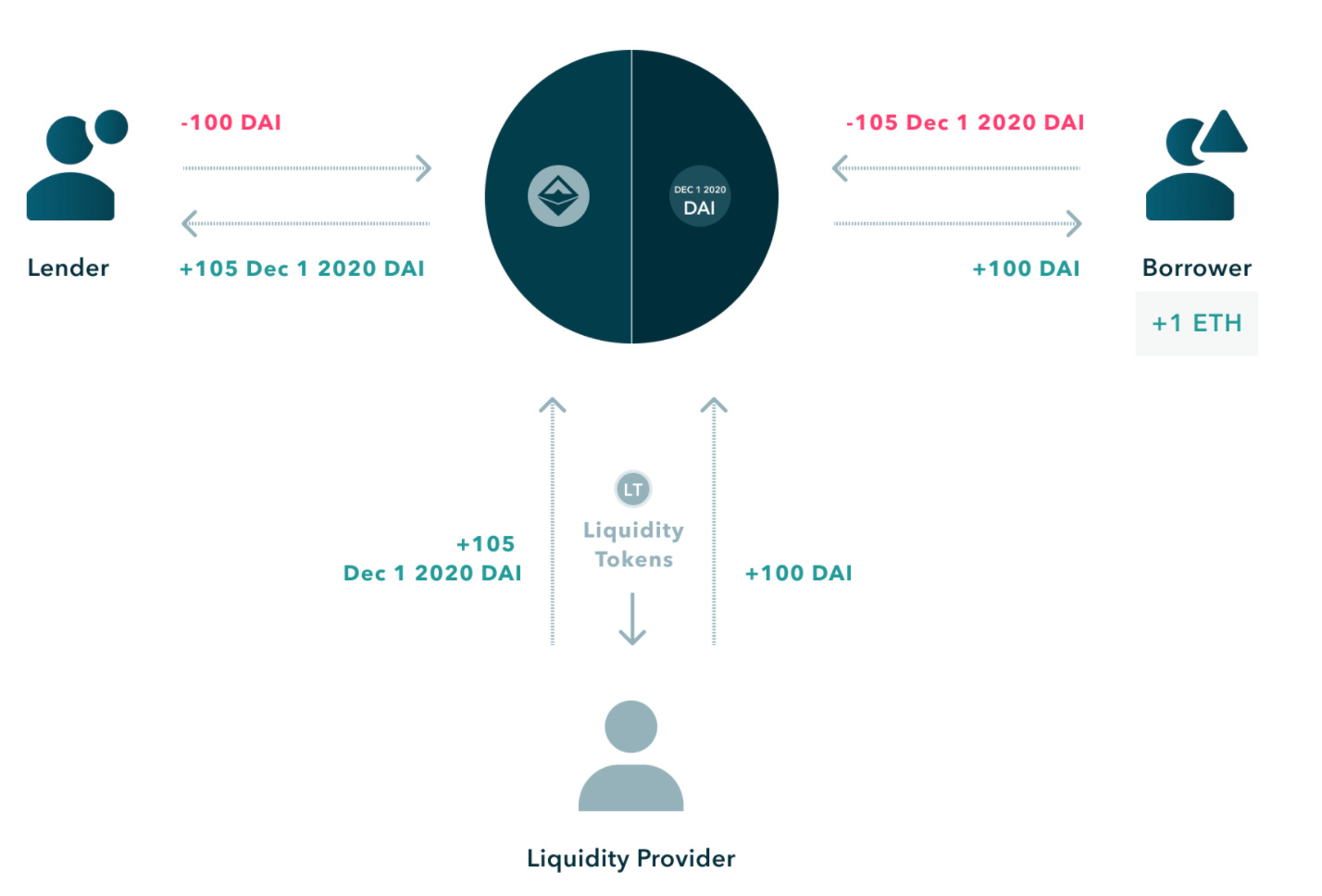

There are three different types of users: lenders, borrowers, and liquidity providers.

Lending and Borrowing

When users want to lend their tokens, they simply have to buy fCash tokens. On a predetermined date in the future, they will be able to redeem their fCash tokens for the initially lent amount of money + fixed interest rate.

This works on the other side as well. When users borrow money, they receive negative fCash tokens and an obligation to pay back their debt + predetermined interest rate on a predetermined maturity date.

Conclusion

Notional Finance solves one of the fundamental problems in the DeFi space. The ability to provide fixed-rate lending makes the DeFi space accessible to more mainstream users and will bring in a flood of new users. Today you can borrow against your crypto without worrying about changing interest rates. Tomorrow you might be able to take out a fixed-rate mortgage on Notional!

That’s why DeFi is so exciting. Every day, there is an innovation that expands the reach of this industry.

We believe that Notional Finance has a good chance of becoming one of the leading lending protocols. However, as always, do your research before you invest in any DeFi project.

Join the Notional Finance Discord to chat with the team and learn more!

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.