Mirroring Stocks on the Blockchain - Mirror Protocol

Hey DEFI TIMES community,

A few weeks ago, we covered Synthetix and Uma Protocol in this newsletter. We explained what derivates are and how they can be implemented on the Ethereum blockchain.

We discussed a crucial problem that both face: The lack of scalability of the Ethereum blockchain. As we talked about high gas fees and scalability solutions many times, it seems to be a good time to cover alternative synthetic asset protocols.

One of the most promising alternatives is Mirror Protocol!

Mirror builds on the Terra blockchain, which is itself located on Cosmos. The Terra blockchain allows you to create decentralized stablecoins, similar to the way Maker works.

However, Terra uses the interoperability and scalability of the Cosmos network to enhance the overall user experience. On Terra, users create TerraUSD (UST) by locking up collateral. As of today, the total UST supply exceeds half a billion dollars - almost 25% of the total DAI supply.

The Cosmos ecosystem is certainly growing at light speed. If there ever was a good time to search for alternatives to popular Ethereum protocols, then it is now!

Let's talk about Mirror Protocol and the Cosmos ecosystem!

Subscribe to our newsletter to level up your crypto game!

How Mirror works

The Mirror Protocol is a synthetic asset protocol building on the Terra blockchain. Users can create synthetic assets, called Mirrored Assets (mAssets). mAssets reflect the price behavior of real-world assets and give traders anywhere in the world open access to price exposure without having to leave the crypto markets. For example, traders might want to bypass annoying KYC/AML regulations.

The minting of mAssets is permissionless and decentralized. Anyone can access the smart contracts on the Terra blockchain. Users need to deposit collateral into the smart contracts to mint mAssets. The assets will always have enough backing as the collateral is liquidated when the collateralization ratio falls below a certain threshold.

Participants of the Mirror Protocol

Four different actors can participate in the Mirror Protocol:

Traders: Traders can buy synthetic assets on Terraswap, which is the dominant exchange on the Terra blockchain. Users trade those assets against UST.

Minters: Minter open a Collateralized Debt Position (CDP) in order to mint a new mAsset. The collateral is either UST or other mAssets. Governance token holders set the collateralization ratio. The CDP's collateral ratio needs to remain above the minimum threshold for minters to be able to withdraw their collateral at any given time.

LiquidityProviders: LP providers deposit liquidity into the Terra exchange, which works similarly to Uniswap. In exchange, users receive LP tokens representing their share of liquidity.

Stakers: Users can stake MIR tokens (native Mirror token) to be eligible for withdrawal fees. They also vote on governance proposals, with their voting rights being proportional to their staked token amount.

Mirrored Assets (mAssets)

As described above, mAssets can be created by locking up collateral in CDPs. mAssets reflect the prices of real-world assets, especially stocks. There are four important properties of mAssets to consider: Name & Symbol, Minimum Collateralization Ratio, Auction Discount Rate, and Price.

Name & Symbol

Describes the underlying asset a particular mAsset tracks.

Minimum Collateralization Ratio

If the collateral falls in value or the mAsset rises in value, which leads to the collateralization ratio falling below the minim threshold, an auction liquidates the contract.

Auction Discount Rate

If the collateralization ratio falls below the threshold, a liquidation auction takes place: People can now buy the collateral for a cheaper price (Auction Discount Rate). This is to ensure that the mAsset is always sufficiently backed.

Price

The current registered price as reported by its Oracle Feeder. This is mainly used for determining collateral ratio for CDP and does not affect the mAsset's trading price on Terraswap directly.

Prices are only considered valid for 60 seconds. If no new prices are published after the data has expired, Mirror will disable CDP operations like mint, burn, deposit and withdraw until the price feed resumes.

For instance, the price feed is halted when real-world markets for the asset are closed. The market hour used to track the price of mAssets is based on Nasdaq trading hours. This does not affect the ability to trade on the asset's Terraswap pool.

Tokenomics

The MIR token is the native token on the Mirror Protocol. If you stake the token, you are eligible for contributing to governance decisions.

In addition, MIR stakers earn rewards, which are generated when users withdraw their collateral from CDPs. Therefore, MIR is a capital asset and profits from the growth of the Mirror user-base. In the future, MIR will also have further use-cases. So MIR will have more utility and, therefore, more intrinsic value.

Mirror token supply

The MIR token is hard-capped at 370,575,000 MIR tokens. The protocol will release them within four years. After that time frame, there will be no more inflation of the token supply.

- 16.7% of the initial token supply will be distributed to UNI holders. So if you held at least 100 UNI on November 23, you are still eligible for the airdrop!

- 16.7% will be distributed to LUNA stakers.

- Community Pool: 66.66% (36.6M) tokens will be allocated to the community pool.

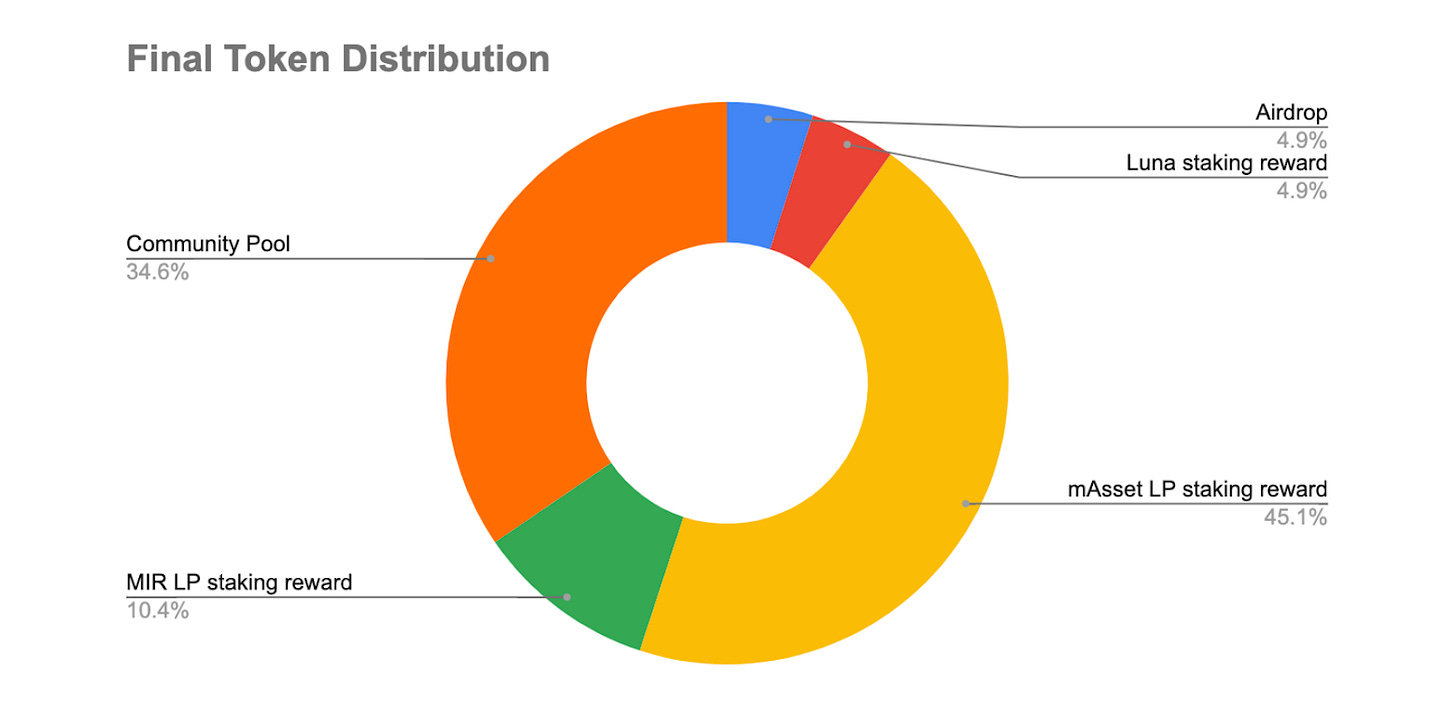

After four years, the token distribution will look like this:

Protocol Fees

MIR Token stakers are eligible to get MIR token rewards in every single block. They are produced by protocol fees from CDP withdrawals. The protocol fees go from CDP collateral and are sold for TerraUSD to buy MIR through Terraswap. The MIR tokens are then sent to MIR stakers proportional to their stake. The idea is that the inflation of the new MIR token will be balanced out by additional buying pressure.

Poll creation fees

When users create a new governance proposal, they first have to deposit MIR tokens in a smart contract. If the proposal doesn't go through, the tokens are proportionally distributed to MIR stakers, which ensures that only high-value governance proposals are created. It's also an additional income source for MIR stakers.

Conclusion

The Mirror Protocol is a scaling alternative to decentralized synthetic asset protocols like Synthetix or UMA on Ethereum. Mirror is built on the Terra blockchain, which is itself located on the Cosmos network.

On Mirror, users create tokens that reflect the price of real-world assets, especially stocks.

Th most common mAssets are: mAAPL, mGOOGL, mTSLA, mNFLX, mQQQ, mTWTR, mMSFT, mAMZN, mBABA, mIAU, mSLV, mUSO, or mVIXY.

So, users have access to the price development of Google, Apple, or Tesla stocks. The Mirror Protocol is an optimal solution for everyone who wants to reallocate their funds to more secure assets while not leaving the crypto markets.

Therefore, if you think that the bull market could be over, consider swapping part of your crypto portfolio into mAssets. Those will not be affected by a crypto bloodbath, as we saw in 2018.

MIR token stakers are also eligible to receive protocol rewards, which turns MIR into a capital asset. From several perspectives, it makes sense to enter the Mirror ecosystem. Whether by diversifying your portfolio or through investing in MIR.

Lastly, if you held UNI on November 23, don't forget to claim your MIR token!

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.