How to keep up to date with DeFi projects

Hey DEFI WORLD community,

DeFi moves extremely fast. Even if you learn about it every day, it is really hard to keep up to date.

For every project that you learn about, there are 5 new ones.

Have you ever wondered how you can keep up with all the development in DeFi?

In this article, you will learn how to use a great tool, that helps you with this exact problem.

DeBank is a data aggregator, which you can use to easily view important metrics in the DeFi space, such as DEXs volume and much more.

We hope you enjoy this guest article.

Guest Post: Chuck W. from DeBank

How to make full use of DeBank on your DeFi journey

What is DeBank?

DeBank is a data-driven all-in-1 DeFi wallet. DeBank is totally free and designed to make lives a lot easier for all DeFi users.

You can access the one-stop web wallet (https://debank.com) on PC or mobile devices (PWA version supported) to navigate to various DeFi applications, manage your DeFi assets, find the best token swap price and look for various opportunities through its real-time on-chain data stats.

You can also check on what do people say about DeBank on Twitter: https://twitter.com/i/events/1260214598470234112

PWA version on mobile devices

1. Portfolio

The Portfolio panel is basically a DeFi watcher wallet where you track your DeFi portfolio from various DeFi products.

As a professional DeFi wallet, the most important thing is to calculate your on-chain portfolio correctly and rapidly. DeBank has supported MetaMask connection and switching between multiple accounts easily.

When you enter any Ethereum address (ENS supported) or choose to connect your MetaMask wallet, DeBank will retrieve real-time smart-contract data from various DeFi products and present your portfolio with detailed stats (collateralization ratio, leverage ratio, liquidation price, APY, yield farming, etc.) back to you within a flash.

At present, DeBank has integrated more than 20 mainstream DeFi products, and provided flash support for checking your APY from yield farming products including Balancer and Compound.

Portfolio with yield farming APY

2. Interest Rates

The DeFi “Interest Rates” panel is a quick comparison tool to compare the saving/borrowing rates for mainstream Ethereum tokens among different DeFi lending platforms.

DeBank has already supported up to 20+ tokens (DAI, USDC, USDT, TUSD, BUSD, ETH, …) from different lending platforms (Compound, Aave, dYdX, Maker, DDEX). You can switch between different time frame (Real Time / 7D AVG / 30D AVG) to check on historical supply/borrowed amount. It’s worth mentioning that we’ve also displayed APY in Compound for yield farmers.

3. Project List

The “Project List” panel is the DeFi entrance to navigate to various DeFi projects.

DeBank is now tracking more than 200 known DeFi projects on our internal “DeFi Radar”. We classify various DeFi projects into different categories such as “Exchange”, “Earn”, “Lending”, “Insurance”, “Assets” to help you build your cognitive system quickly.

Every week, DeBank will list several popular DeFi projects from our “DeFi Radar” and introduce them from an user perspective with some background information including “Total Value Locked”, “Trading Vol”, “Data”, “Platform Token”, “Liquidity Pools Ranking”, “Trading Pairs”. We’ve listed around 60 DeFi projects on Ethereum and will list more going forward to help you keep up with the new DeFi trend.

Balancer “Data” tab: BAL mint APY integrated for liquidity pools ranking

Balancer “Platform Token” tab: integrated data for Market Pairs

4. Ranking

The "Ranking" panel is a leaderboard for different categories.

The "Total Value Locked" and "DEX" leaderboards are the two rankings quoted most in the DeFi community currently.

The "Market Cap" and "BTC-pegged coin" are the new ones we just added recently.

4.1 "TOTAL VALUE LOCKED" Ranking

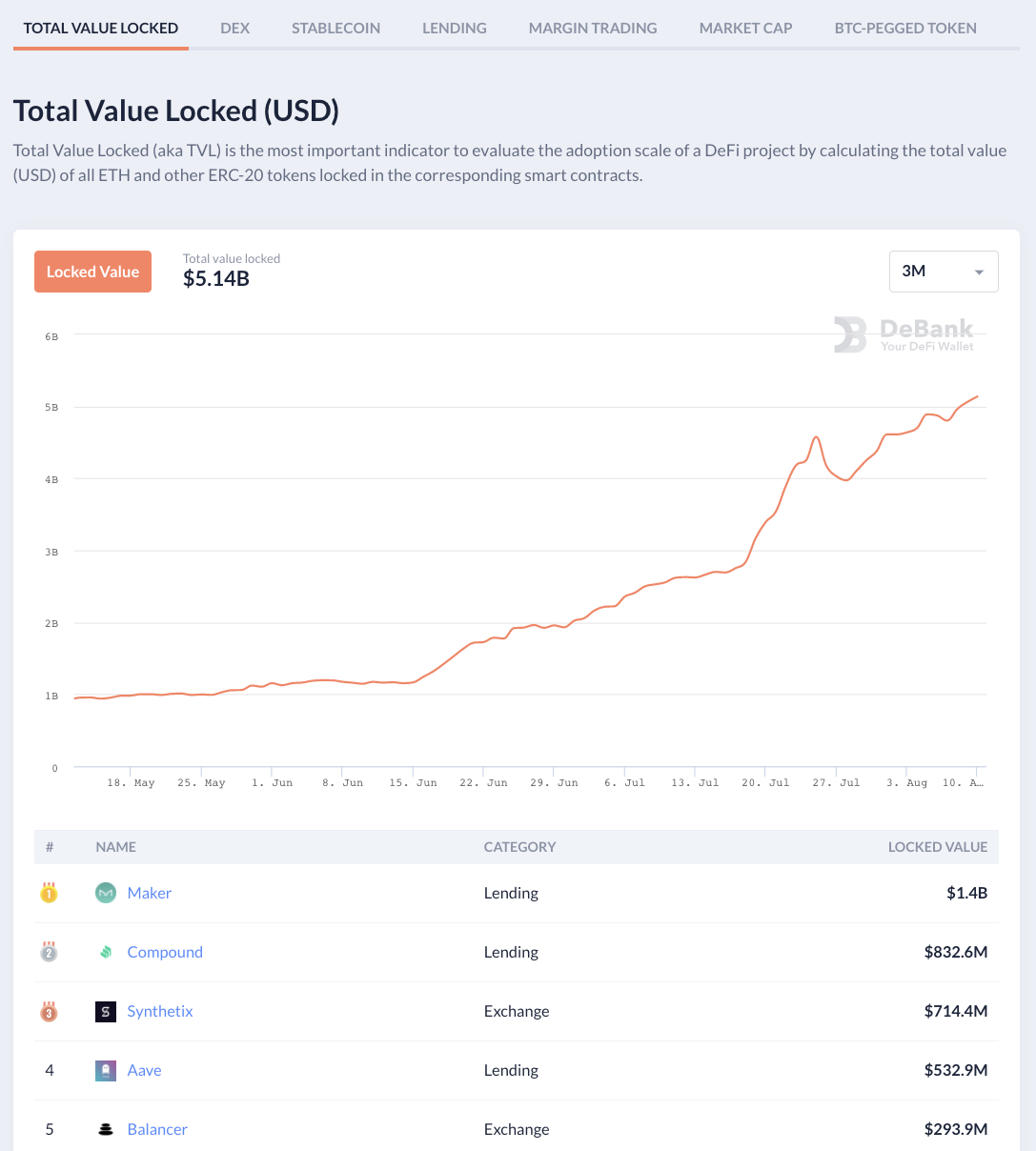

Total Value Locked (aka TVL) is the most important indicator to evaluate the adoption scale of a DeFi project by calculating the total value (USD) of all ETH and other Ethereum-based tokens locked in the corresponding smart contracts.

You might have seen its TVL charts cited by some top-tier media, ventures, and research institutes a lot recently because they've provided the best-quality TVL stats. You can switch among different time frames (1 Month / 3 Month / 1 Year / Max) to have a rough idea about what is the market situation.

4.2 “DEX” Ranking

In the old days, it’s very difficult for us to know the real trading vol in CEXes as faked vol is everywhere, while DeFi projects offer the possibility to get real trading volume due to their transparent on-chain ledgers.

In fact, most DEXes do provide API for trading vol, which is the most low-cost solution for integration. DeBank, as a professional DeFi wallet, they stick with the rule — “Don’t trust, just verify!” and get all data from on-chain ledgers instead of 3rd-party API to provide the most independent DEX vol ranking.

They’ve chosen the hard way but we believe this is the right way. Someone in the industry has to do it this way and that’s why they’re here and why DEXes refer their DEX vol stats for competitive product analysis.

4.3 “Stablecoin” Ranking

Stablecoins are crypto tokens used as fiats on blockchain, usually pegged to fiat currencies, audited by 3rd-party organizations, backed by real USD reserve or complex algorithms.

DeBank has included 10+ mainstream USD stablecoins on Ethereum with detailed stats such as “minted”, “holders”, “24H Txs”, “24H Tx Vol”, etc.

4.4 “Lending” Ranking

Support “Compound, Maker, Aave, dYdX, DDEX, Nuo” with stats about “borrowing volume”, “total volume” and “liquidation volume(24H)”.

4.5 “Margin Trading” Ranking

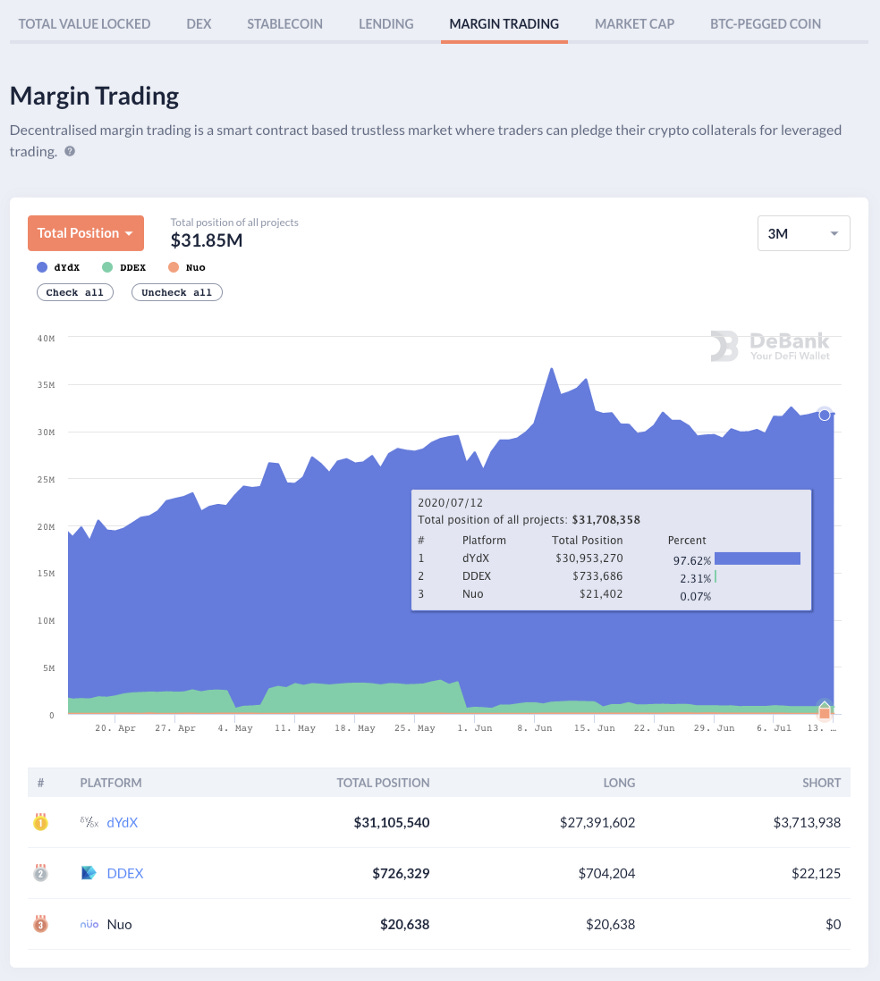

Support “dYdX, DDEX, Nuo” with stats about “total position”, “long positions” and “short positions”.

4.6 “DeFi Market Capitalization” Ranking

As for the market cap, DeBank has integrated around 27 DeFi projects with platform tokens and provide stats about "price", "volume(24h)", "circulating supply", "change(24h)" and "7-day price change".

“DeFi Market Capitalization” Ranking

4.7 "BTC-Pegged Token" Ranking

In the "BTC-pegged token" ranking, DeBank has integrated 8 major BTC-pegged tokens on Ethereum and provides statistics about "minted", "locked value" and "market dominance%".

5 Summary

As a free data-driven all-in-one DeFi wallet, DeBank has integrated various DeFi protocols and provided flash support for new project features and favorited by many DeFi enthusiasts in the community.

“Token Swap” feature to be released soon

There’s also an exciting feature -- “Token Swap” labelled as “Under development” that is designed to find the best price (exchange rate + gas fee) among all DEXes and DEX aggregators on Ethereum.

It uses an optimized price-comparison engine to look for the best price (exchange rate + gas fee) among various AMM-based DEXes, orderbook-based DEXes & DEX aggregators with slippage verification function. You can check "actual slippage" in the "Swap History" panel after your transaction. It’s still under development and said to be released in a week or two. Feel free to find them on Twitter, Telegram, Discord and WeChat.

Twitter: https://debank.com/twitter

Discord: https://debank.com/discord

Telegram: https://debank.com/tg

Medium: https://debank.com/medium

GitHub: https://debank.com/github

WeChat: https://debank.com/wechat

All information presented above is for educational purposes only and should not be taken as investment advice.