Hey DEFI TIMES community,

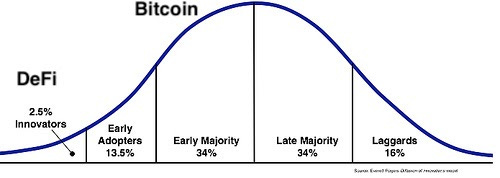

DeFi is still a very small niche. While Bitcoin has millions of users and is known globally, the world is yet to discover Decentralized Finance.

That means DeFi is a lot earlier in the adoption curve than Bitcoin. While bitcoin could have crossed the early adopter phase already, DeFi is certainly yet to pass it.

The best way to track the innovation stage of DeFi is to count the number of unique DeFi users.

There are over 7.8 billion people in the world, which is exactly the total addressable market of DeFi - everyone is in need of financial services. However, as of 2018, more than 1.7 billion people don’t have access to a bank account.

Mass adoption seems inevitable at this point. So let’s find out where we are at in the innovation curve.

That means: how many people actively use decentralized financial services?

Let’s find out!

Subscribe to our newsletter to level up your crypto game!

How Many DeFi Users Are There?

Ethereum DeFi users

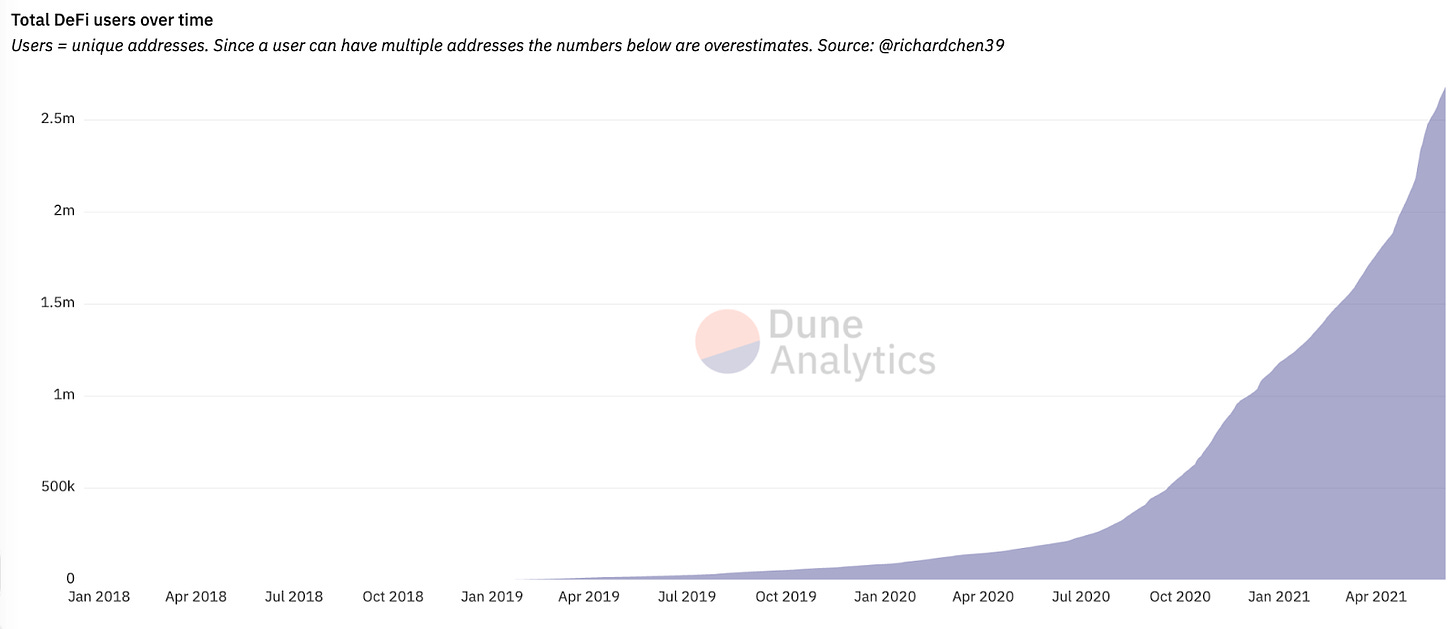

The best way to approach this problem is to track the unique addresses over time that have interacted with DeFi protocols. If we take a look at the Dune Analytics chart, we see that the number of unique addresses has hit 2.6 million recently.

Now we have a problem: unique addresses do not represent unique users because a single user can have multiple addresses. That’s why we can only approximate the actual number of users rather than calculating it.

To approximate the total number of DeFi users, we have to guess how many addresses a typical user possesses on average.

The problem is very tough because there are many factors to consider.

In this article, I will guess the average number of Ethereum addresses per user - in a very simplified way. Let’s begin by figuring out the three different groups of DeFi users.

First of all, we have to consider the “DeFi power users.” These are users with ten or more addresses. They interact with DeFi protocols every day. “DeFi power users” also include “airdrop hunters.” People who create multiple addresses and interact with tokenless DeFi protocols in order to be eligible for an airdrop in case the protocol issues a token in the future. Even though these people possess ten or more addresses, they only represent a small portion of all DeFi users. Let’s assume that only 5% of DeFi users possess ten or more addresses.

Then, we have a moderate number of people who possess 2-3 addresses for various reasons. Some of them might feel “more safe” knowing that not not all of their crypto holdings are stored on one single address. I would guess that 45% of all DeFi users possess 2-3 addresses.

Then we have the last group of DeFi users: the newbies. These are people who rarely interact with DeFi protocols. They probably tried it out once or twice but are not really interested in using it more regularly. These people typically have only one address. Let’s assume that this is the largest part of DeFi users - they could make up over 50% of existing users.

Now, let’s figure out how many addresses a typical user possesses on average:

5% power users —> 10 addresses

45% regular users —> 2 addresses

50% newbies —> 1 address

Average number of addresses per user = 0.05 * 10 + 0.45 * 2 + 0.5 * 1 = 1.9

That would make an average of 1.9 addresses per user.

Considering the fact that unique addresses have recently hit 2.6 million users, we could conclude that 1.36 million people have used DeFi services in their lives.

Note that we have only looked at Ethereum here. There are dozens of other chains that have attracted new users. The most prominent one is Binance Smart Chain, which has brought a lot of new users into the crypto space. So the actual number might be even higher than 1.36 million.

Also note that the numbers above have to be taken with a grain of salt as they are only guesses - based on my personal crypto experience. The actual numbers could be way higher or lower.

Feel free to respond to this email if you have any additional thoughts and ideas! Would love to chat!

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.