HONEY - How to Buy Honey (HNY) Using HoneySwap

Hey DEFI TIMES community,

most of you guys have been through DeFi summer 2020. It was a euphoric time; DeFi tokens were skyrocketing, and many venturesome investors became millionaires overnight. Everything was fine, but there was one annoying fact: gas prices were way too high.

Due to the high demand for DeFi protocols, a transaction on Uniswap cost approximately $30, and the transaction fees on 1inch exchange were as high as $100. Ultimately the bubble burst because of these reasons. There were no alternatives for people to swap tokens cheaply.

That's why we desperately need scaling solutions for Automated Market Makers (AMMs). AMMs are by far the most used DeFi protocols. Not everyone wants to lend their tokens, but you must EXCHANGE your tokens to participate in DeFi in the first place. That's why Uniswap currently settles about $260 million in daily transactions volume.

As the number of DeFi users grows, we will need better scaling solutions. How much will your Uniswap transaction cost when the protocol settles about $3 billion in daily volume? Quick answer: too much for the average user.

Today we would like to introduce a brand new AMM to you built on the second layer solution xDAI: HoneySwap.

Let's dive straight into it!

Level up your crypto knowledge and subscribe to our newsletter!

How HoneySwap works

HoneySwap is a fork of Uniswap building on the xDai chain. To understand what makes HoneySwap special, you have to understand what xDai is in the first place.

"The xDai blockchain is a sidechain of the Ethereum blockchain. It has the same properties as Ethereum but uses a different method to ensure transactions are valid and consistent across all nodes in the distributed network. xDai is the name of a blockchain AND the stable cryptocurrency used on the chain. Each xDai token is worth ~ 1 US dollar."

xDAI is extremely fast because it produces blocks every five seconds, which minimizes the transaction fees and makes quick transactions on AMMs possible. Currently, only known validators can become nodes, but xDAI will switch to public staking shortly, decentralizing the chain.

This environment is perfect for an AMM like HoneySwap. There are no exorbitant transaction fees, which makes the chain bulletproof for parabolic bull runs ;)

If you want to use HoneySwap, you must first move your DAI on the xDAI chain. This process works in the following way:

Step 1: open Metamask

Step 2: click on Ethereum Mainnet

Step 3: click on “Custom RPC”

Step 4: Type in the following information:

Network name: xDai

RPC URL: https://xdai.poanetwork.dev

ChainID: 100

Symbol: xDai

Block Explorer URL: https://blockscout.com/poa/xdai

Step 5: Bridging DAI to xDAI

After that, you will need to bring your DAI from the Ethereum main chain to the xDAI side chain. Copy the following URL in your browser https://dai-bridge.poa.network/.

This is what you will see—type in the amount of DAI you want to buy Honey with. Click on transfer, and you are good to go. I don't have any DAI in my wallet yet, which is why my balance shows 0.00 DAI.

Alright, so now you have your xDAI on the xDAI chain. Before you can buy Honey with it, you need to switch your Metamask's network to the xDAI chain.

Step 6: Buy Honey (HNY)

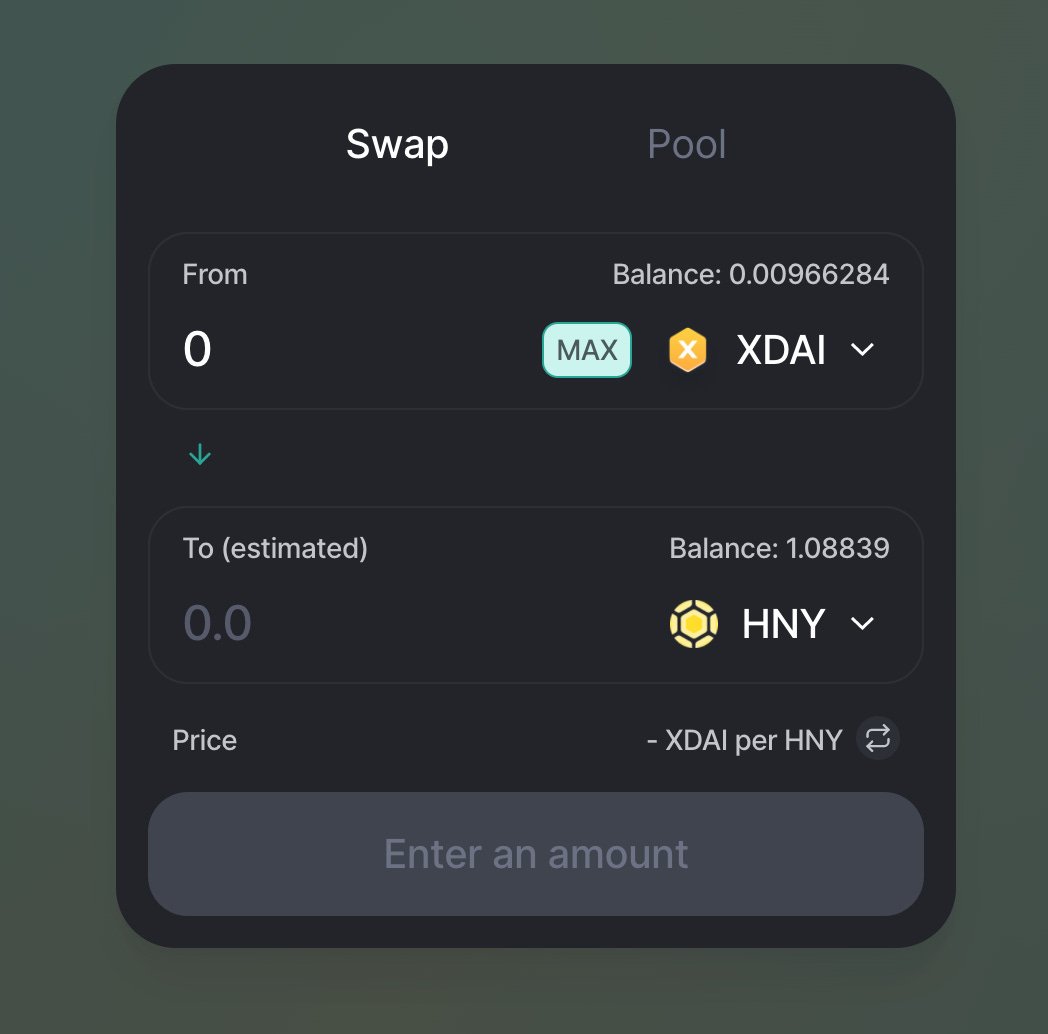

Visit https://honeyswap.org/#/swap. There you will see an interface that looks very similar to Uniswap (As explained above, Honeyswap is a fork of Uniswap).

Type in the amount of xDAI you want to swap and swap it. Congratulations, you made it! Wasn't too hard, right?

Step 7: Add HNY token in your Metamask

To see your HNY in your wallet, you will need to add a custom token in your Metamask. Click on "Add token" then on "Custom token".

Type in the following information:

Token contract address: 0x71850b7E9Ee3f13Ab46d67167341E4bDc905Eef9

The rest will be filled out automatically. Now you will be able to see your HNY tokens in your wallet. Be aware that you will only see them if you are connected to the xDAI chain. If you are connected with the Ethereum mainnet, you will not see them.

Tokenomics

The Honey token (HNY) is the governance token of the HoneySwap protocol. Every block, HNY tokens are issued to the "Common Pool", which is the treasury fund of HoneySwap.

Honey community members, who contributed to the development of HoneySwap, can create proposals and ask for HNY as a reward.

So HNY is a way to incentivize community-driven development of the HNY protocol. Currently, HNY holders do not earn trading fees of HoneySwap. The trading fees are currently allocated to liquidity providers. But as HNY is a governance token, HNY holders can vote in trading fee allocation anytime in the future.

Conclusion

HoneySwap is an excellent alternative to Automated Market Markers on the Ethereum mainnet. It already has some significant traction as the volume is currently around $120,000 in the last 24 hours.

The volume in October was as high as $3,000,000 on some days. This is a perfect sign as it shows that some form of product-market fit has been reached already. There's also a fair amount of liquidity in HoneySwap pools profiting from the platform's trading fees.

All in all, we at DEFI TIMES believe that HNY is a fantastic project that could solve the scalability problems in the DeFi space. We are convinced that layer two solutions will become increasingly important in the future, especially in the next couple of months.

As DeF is continuing to grow at this speed, gas prices will reach unsustainable highs soon. People will search for alternative places to trade their tokens.

Only you can decide whether or not to invest in HNY. However, we believe that every protocol that contributes to solving the scalability problem is worth keeping an eye on.

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.