Elon Musk & Bitcoin: The Bull Market Can’t Stand the Elon FUD

How the Elon FUD could lead to environmentally neutral future

Hey DEFI TIMES community,

The last few days have been chaotic. Elon Musk went crazy on Twitter with several Bitcoin-critic tweets. There is nothing wrong with Bitcoin criticism per se; However, Elon dropped quite a few bombs in the last few days.

Probably one of the biggest fear was caused by one particular tweet:

Elon’s answer to Mr. Whale caused many people to believe Tesla has sold all their Bitcoin - and of course the crypto markets took a deep dive!

Rest assured… It was pure speculation!

Just afterward, Elon clarified the news and confirmed that Tesla has not sold any Bitcoin to this day.

Okay, Tesla still owns BTC.

But the question is: For how long?

Today is all about a completely new wave of FUD: The Elon FUD. And it seems like it’s one of the worst kinds of FUD we have seen to this date.

What’s Elon’s incentive to dump the crypto markets when Tesla still holds their BTC?

Let’s find out…!

Subscribe to our newsletter to level up your crypto game!

Elon Musk & Bitcoin: The Bull Market Can’t Stand the Elon FUD

Elon’s incentives

There’s no doubt Elon stopped the bullish momentum we had over the past couple of weeks! In fact, the Fear & Greed Index shows that most people are panicking!

The last time the crypto markets experienced such an extreme situation was just after the Corona crash in March 2020.

This kind of fear doesn’t happen very often - it’s a unique situation we have to deal with!

With one single tweet, Elon caused one of the biggest sell-offs since months! But why does Elon dump the prices of his own bags?

The best way to understand Elon is to understand his incentives. As Charlie Munger always says: “Show me the incentive and I show you the outcome!” This quote applies to every human being, even to unstable billionaires!

What’s Elon’s incentive to dump the Bitcoin price?

It probably comes down to the most valuable asset Elon possesses: Attention!

I want to refer to one single threat I read about Elon’s “irrational behavior.”

Elon’s incentive is to build his personal brand. The fact that Elon was late to the “Bitcoin party” doesn’t turn him into a Bitcoin native billionaire. Elon never wanted to be the face of Bitcoin. All he wanted was attention and this is exactly what he’s seeking right now.

But why does he prefer attention over Bitcoin gains? Well, because attention is more valuable than money. Attention is the currency of the internet.

Elon’s Bitcoin tweets put him into the discussion of the Bitcoin community.

Remember: Bad publicity is the best kind of marketing. Elon is a marketing genius and he knows how to provoke the public!

Do you remember the car window “accident” when Elon first introduced the Cyber Truck? - Different occasion, same story! Bad publicity puts you into the spotlight of global attention. The fact that people talk about Elon strengthens his personal brand… and this is exactly what he wants!

He prefers attention over Bitcoin gains… because attention is more valuable than paper gains!

The more people talk about Elon the more important his opinion becomes. He just is trying to build his reputation.

Is This a Top Signal?

During the last couple of days, people were speculating whether this could “kill the bull market.” And this is a valid question! The markets experienced quite a significant sell off after Elon put out his tweets. We see extreme fear and people are leaving the markets as we speak.

However, the true question you need to ask yourself is whether or not the facts changed.

Remember: Only change your mind when the underlying facts change!

Luckily, nothing really changed except that a billionaire put out some (valid?!) criticism about Bitcoin.

Elon’s critique doesn’t change Bitcoin per se. In fact, the reality is exactly the same of what it was a month ago!

In my opinion, this is just FUD, which is present in every single Bitcoin bull cycle we had before! FUD is the reason most people actually lose money in bull markets. The hardest thing in a bull cycle is to ignore the noise and focus on the signal.

Signal is when facts change. On the other hand, opinions and criticisms are just noise. So, keep your head straight. As much as we value Elon’s opinion, he is also a human being that has flaws and makes mistakes!

Elon & BCH FUD

Every bull market has its own kind of FUD and it seems like the Elon FUD… is very similar to the Bitcoin Cash (BCH) FUD in 2017!

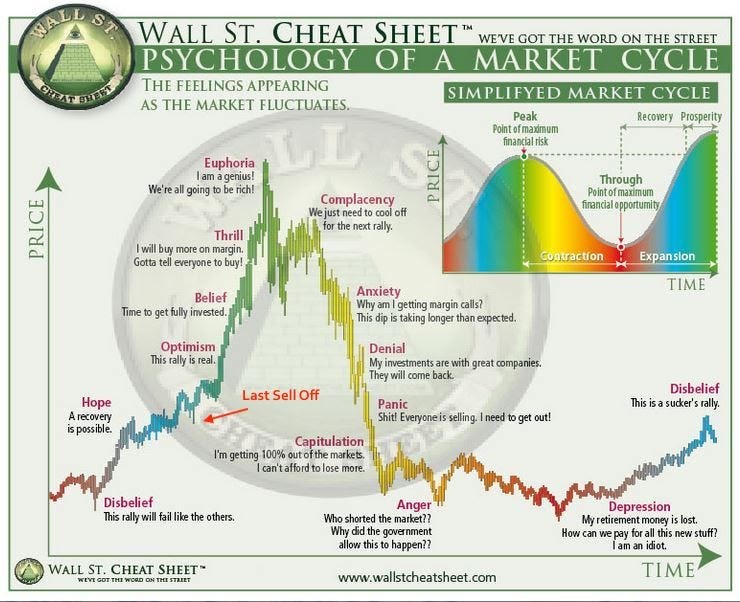

Are you familiar with the famous Wall Street Cheat Sheet? If not, inserted it down below.

The Wall Street Cheat Sheet basically shows the different stages any bubble goes through:

Hope

Optimism

Belief

Thrill

Euphoria

However, there is one thing that is shown in the chart but not particularly mentioned: The last sell-off before the parabolic rally.

The last sell-off is the last time a market dumps significantly before the bubble really hits. I claim that the Elon FUD was the last sell-off in the great crypto bubble of 2021.

But before we can understand why this could be the case, let’s first examine a very similar situation that happened in 2017: The BCH FUD!

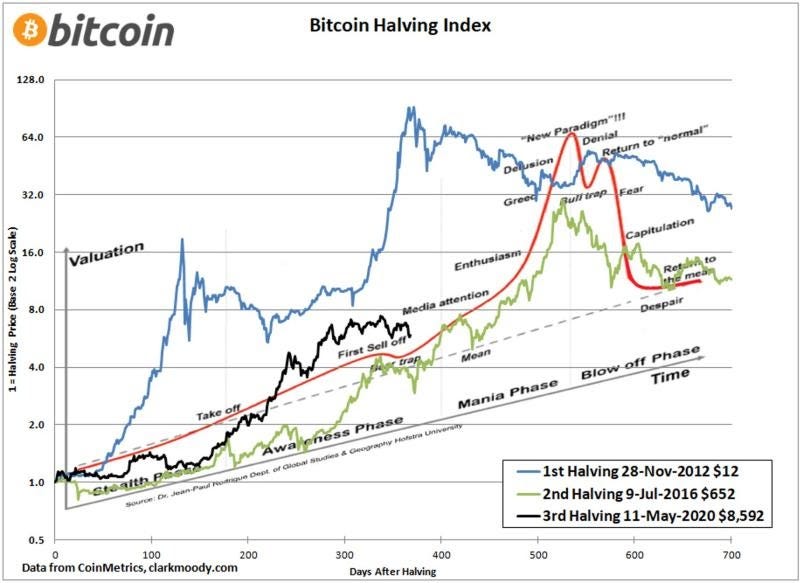

When we compare the number of days after the last Bitcoin halving, we can see that we had a very similar sell-off in mid 2017. But what actually happened in July 2017?

Well, on August 1, the Bitcoin blockchain was forked, and a new blockchain was created: Bitcoin Cash. If you have been around at that time, you probably remember how uncertain the situation was. Nobody knew which blockchain would prevail to be called “The Bitcoin blockchain.” The “big blockers” fought against the “small blockers.”

But ultimately, the fight was won by the “small blockers” and the conflict was resolved; However, along the way, the market experienced a lot of volatility because the winner was yet to be determined.

The last sell-off was the time when uncertainty was at its peak: Just a few days before the Bitcoin Cash hardfork.

At that point, the bull market could have ended any time - people were scared.

But in the end, the bull market continued… in a big way!

I believe that the Elon FUD is very similar to the Bitcoin Cash FUD in 2017.

If you are worried about the current situation, look back at what happened in previous bull cycles. What actually changed during the last couple of days?

In 2017, Bitcoin was still called Bitcoin after the BCH hardfork.

In 2021, Bitcoin is still Bitcoin after Elon’s tweets.

Nothing really changed… and neither should your opinion!

I don’t think the bull market is over at this point. Elon criticised Bitcoin - in a totally legit way! Bitcoin does have an energy problem and we need to solve it - nothing new.

But now, the question is: What can we expect going forward?

What Does the Future Hodl?

Okay, Elon kicked off the Energy debate again.

He basically claimed that Bitcoin miners increasingly use fossil fuels for their energy. Even though this has been debated several times in the past, the discussion is now more present than ever before!

Proof-of-Work requires a lot of energy - and it incentivizes miners to spend even more resources. However, just as Elon tweeted about it, the world came to realize this fact.

The world is moving into a greener direction. We shouldn’t make an exception with cryptocurrencies.

That probably means that Proof-of-Work could be at risk of becoming a thing of the past. Other consensus algorithms, that are environmentally neutral, could turn out to be the winners here.

Proof-of-Stake is definitely one of the most promising ones. Above all, Ethereum could profit the most from this trend.

The merger could already happen as early as 2021. This could potentially strengthen ETH’s role as an environmentally friendly store of value. The world could realize that ETH has better properties than BTC - in terms of both hardness and utility.

Conclusion

Elon’s tweets probably didn’t cause a bear market; however, they shifted the global attention away from Proof-of-Work towards Proof-of-Stake.

Ethereum could potentially profit immensely from this trend. However, not only Ethereum, but also any other PoS/DPoS blockchain.

They use very little resources and are, in fact, better suited for an environmentally friendly future!

Let’s see what the future holds!

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.