DeFi Chain – An in-depth Analysis of Decentralized Finance on Bitcoin

The DeFi Blockchain is a project initially started by the DeFi Foundation, comprised of Dr. Julian Hosp, U-Zyn Chua, John Rost and Kenneth Oh. Julian is known as an expert in the cryptocurrency industry and has founded several companies including Cake DeFi, a company that enables cashflow for digital assets. U-Zyn Chua is a technical engineer, who specialized in Blockchain development.

The DeFi Blockchain promises to bring decentralized finance to the Bitcoin-Blockchain. It aims to enable high transaction throughputs while keeping the blockchain robust and decentralized. It also provides a non-Turing-complete infrastructure, which should make decentralized applications safer. The general problem with existing DeFi applications is their complexity, which makes them vulnerable to smart contract risks. In this way already millions of dollars have been lost due to malicious attacks. The DeFi Blockchain addresses this issue with its non-Turing-complete scripting language, called Recipe, which only enables a certain amount of functions to prevent high complexity for decentralized applications.

In order to understand how exactly the DeFi Blockchain is able to expand the DeFi space to the better, let’s take a closer look at the technical details.

The Blockchain

The DeFi Blockchain is one of the first Blockchains, that leverages Bitcoin’s high security. With Bitcoin never having been hacked before, it seems to be the perfect base layer to secure trustworthiness. Thus, the DeFi Blockchain ensures five essential pillars:

Robust and secure Blockchain

High transaction throughput

Decentralized consensus

Extensible smart contract support

Immutability

1. Robust and secure Blockchain

The DeFi Blockchain is built on Bitcoin Core 0.18 and is therefore a Bitcoin fork with several adjustments. While Bitcoin has never been hacked, its code should build a valuable fundament to the security.

2. High transaction throughput

In order to guarantee a scalable blockchain, the block-time was decreased to 30 seconds, while the block size was increased to 16 MB.

3. Decentralized consensus

The DeFi Blockchain leverages the best of both consensus worlds, precisely Proof of Work (PoW) and Proof of Stake (PoS). Proof of Work is being used to hash the staking node’s ID for block creation. PoS makes the majority of its consensus algorithm, where master nodes, who stake more than 1.000.000 DFI (native DeFi Chain token), can participate.

4. Extensible smart contract support

Instead of similar Blockchains like Ethereum, the DeFi Blockchain integrates a non-Turing-complete scripting language called Recipe. This language enables smart contracts, which are suitable for financial applications but limits the amount of actions of a programmer. This ensures the safety of the chain while providing enough possibilities to build decentralized financial applications.

5. Immutability

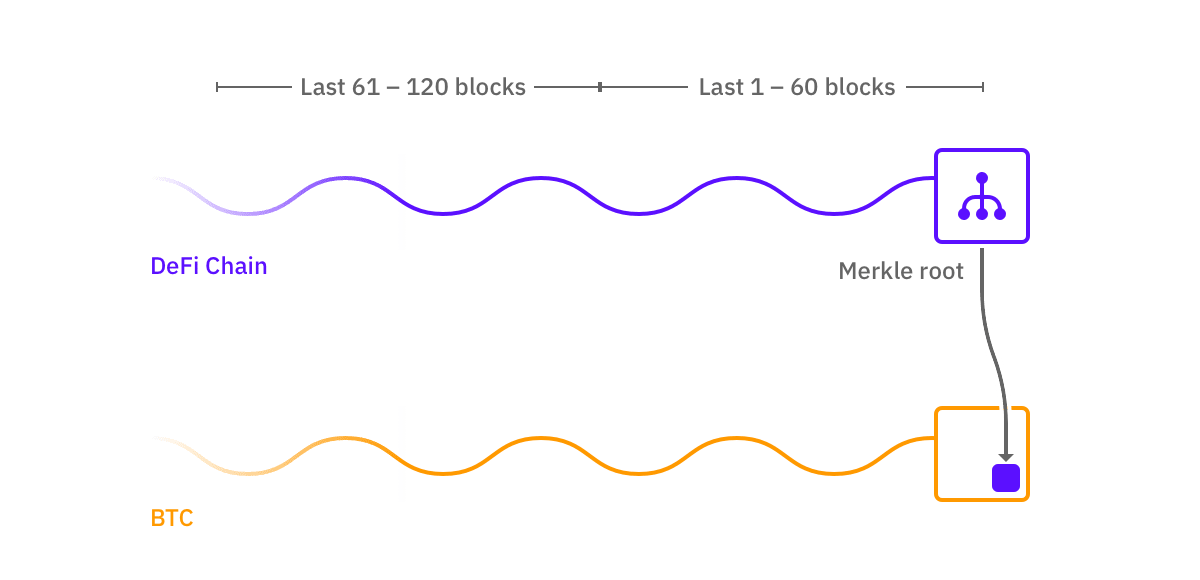

In order to prevent a 51%-attack, the DeFi blockchain is very closely attached to the Bitcoin Blockchain. This ensures that it is almost impossible to hack. Regularly the Merkle Root of the DeFi Blockchain is anchored on Bitcoin. Therefore, in order to hack the DeFi Blockchain, Bitcoin has also to be hacked. Good luck trying!

Tokens on DeFi Chain

There are two different kinds of tokens on the DeFi Blockchain.

1. DeFi Custom Token (DCT)

Basically, any user can create a DeFi Custom Token. To do so, he has to lock 1.000 DFI. Similar to the ERC-20 standard on Ethereum, an DCT can represent anything the user wants. Once the tokens are revoked, the user gets his locked tokens back.

2. DeFi Asset Token

A DeFi Asset Token is always backed by another token, mainly outside the blockchain. For example, a DAT can represent a bitcoin on the DeFi Blockchain (DBTC). It could also represent an Ether, similar to the concept of WBTC (Wrapped Ether) on the Ethereum Blockchain. The goal is to always have to token back 100%, so a DAT can always have the same value as the underlying asset.

Potential use cases of the DeFi Blockchain

The dominant use case of the new blockchain is clear: it is all about decentralized applications. Therefore, it expands the existing DeFi ecosystem, which has mostly been on Ethereum in the past and makes financial applications safer, more scalable, and cheaper. There are many potential ways that the DeFi Blockchain can be used going forward. Among others, here are the most important ones:

1. Decentralized lending

2. Wrapped tokens

3. Pricing oracles

4. DEXs

5. Transferable debt and receivables

6. Decentralized non-collateralized debt

7. Asset tokenization

8. Distribution of dividends

1. Decentralized lending

Decentralized Lending will eliminate middlemen, such as banks, in the future. At first, this service will only be possible with fully collateralized loans. In order to receive a loan, one has to deposit the equivalent value of the loan and lock it up as a security. This will change when undercollateralized loans will be possible in the future, but more on that later.

2. Wrapped tokens

Other digital assets can be wrapped on the DeFi Blockchain. For example, a user will be able to replicate the value of a bitcoin on the DeFi Blockchain with a token that is fully backed by a BTC. As mentioned above, this will be possible with DATs.

3. Pricing oracles

Pricing oracles are an essential part of a decentralized financial ecosystem because they are a trustless way to feed the smart contracts with data from the outside world. This could be stock prices or outcomes of football matches. Initially, oracles can only be implemented with trusted parties.

4. DEXs

With a decentralized exchanging mechanism, people will be able to swap their DCTs or DATs seamlessly. This will work with atomic swaps, which is a Peer-To-Peer, instant, and feeless way to exchange tokens, while not having to rely on third custodial services. There are already similar DEXs in the Ethereum ecosystem: Uniswap, Balancer, Kyber, and some more. These liquidity pools have gained a lot of attention in the last quarter and it can be expected that DEXs on the DeFi Blockchain will gain a similar popularity.

5. Transferable debt and receivables

The point of transferable debt and receivables is to make the debt market more efficient. While it is difficult at the moment to receive a credit in a short period of time, this mechanism will enable more transparency and therefore faster loan execution and better interest rates for the receiver. For example, while Alice has to wait several weeks for her credit within the old system, she can now apply for a loan on the DeFi Blockchain in a matter of minutes and will receive feedback shortly after.

6. Decentralized non-collateralized debt

Non-collateralized debt has been a problem for a very long time in the crypto space. While some people claimed that this could never happen, the DeFi Blockchain is planning to develop a reputation-based system for undercollateralized loans. Based on your credit history and how you paid back your liabilities in the past, you will be able to receive loans without any collateral. The more trustworthy the algorithms estimate you, the more likely it is for you to receive the credit. This mechanism could also enable the development of under-collateralized stable coins.

7. Asset tokenization

As discussed above, DeFi Asset Token will allow real-world assets to be tokenized on the DeFi Blockchain. Tokens can, therefore, be used to represent ownership of a certain asset class in the outside world. Some examples can be:

· Real estate

· Equity

· ETFs

· Patents

· Self-driving cars

· Solar farms

Thus, every asset class that produces cash flow can be replicated on the DeFi Blockchain. The owner of the token will hence receive a cash flow of the underlying asset.

8. Distribution of dividends

The underlying asset will distribute the dividends much faster to the owner than in traditional finance. Decentralized Finance will bring the possibility to distribute dividends much more frequently, such as every day, every hour, or even minute by minute.

DFI Token

The DFI Token is the native token on the DeFi Blockchain. It serves as a unit of account and will be the base of several key blockchain features. The most important use cases are summarized below:

· Transaction fees: for DEXs, token transfers or loan interest payments

· Collateral for borrowing other crypto assets

· Run a staking node to participate in decentralized consensus (1.000.000 DFI tokens are required to run a staking node)

· Create a DCT

· Proposals for the community budgets (500 DFI required)

It is important to mention that transaction fees are burnt at first but are later distributed to the staking nodes through new token minting.

block reward = reward schedule + burnt tokens

Initial Token Distribution

DFI is capped to 1,2 billion tokens just as Bitcoin is hard-capped to 21 million. 49% of the 1,2 billion DFI are distributed to the DeFi Foundation and external partners.

Above you can see the inflation schedule of DFI. Every year the block reward is incrementally lowered. For this reason, after ten years almost all tokens will be emitted.

Conclusion

In our opinion, the DeFi Blockchain is a very interesting project to keep an eye on due to its aim to solve most problems the DeFi space currently faces, such as high network fees and the lack of security. Non-Turing-complete smart contracts could be the solution to many hacks and security incidents. While being attached to Bitcoin, not only the DApps on the DeFi Blockchain are safe, but rather the whole blockchain is protected from a 51% attack, which is quite a threat in an early stage of development.

The only problem, that we at DEFI WORLD see, is the lack of network effect. Since the DeFi Blockchain is not being attached to Ethereum, it could miss out on some significant projects, that decide to run on more established blockchains such as Ethereum.

If the DeFi Blockchain could though potentially catch high-quality projects over the next months and years, it could acquire its network effect and thrive on its own. Ultimately, this project could be part of a better, more inclusive, open, and decentralized financial system.