Decentralized Hedge Funds on Ethereum - dHEDGE

Hey DEFI TIMES community,

The traditional asset hedge fund industry hides many problems, which make it extremely difficult for funds to enter.

In most developed countries, you have to pay hundreds of thousands of dollars to bring your fund to market. Of course, the high barriers hinder innovation as small players get priced out of the game.

You all know what comes next: blockchains solve this!

dHEDGE makes decentralized hedge funds possible! Today, Henrik Andersson explains everything you need to know about it!

Subscribe to our newsletter to level up your crypto game!

dHEDGE - Decentralized Hedge Funds on Ethereum

The traditional asset management industry has very high barriers to entry, it got a lot of middlemen, is expensive and it’s very opaque. In addition, it’s local. On the supply side this means that there are very few portfolio managers that get the chance to prove their skills. This is because it’s very expensive to run a managed fund and you need a critical mass of funds under management. On the demand side, it’s hard to gather information about funds, and to compare the market. Being local in nature, it’s prohibitive to access global managers.

Blockchain and crypto has the power to change the status quo. DeFi creates open, permissionless infrastructure for new financial primitives. We believe decentralized asset management is a core new primitive for this new infrastructure.

We set up dHEDGE with the vision to democratise investing and level the playing field. We thought the permissionless nature of Ethereum was the perfect platform to build a software protocol to do just that.

For a decentralised asset management protocol to work you need to make sure funds are safe and that they can’t exit the pool while at the same time allow the manager a lot of freedom. Setting out to build dHEDGE, we understood that Synthetix, another Ethereum protocol, would be the perfect platform to integrate dHEDGE with. The benefit with Synthetix is that they offer synthetics on many different assets like crypto, commodities, FX and even equity indices. With the inverse synths, it is easy for the manager’s on dHEDGE to get a short exposure to these assets as well. Another benefit of Synthetix is that all trading is zero-slippage which is really fantastic and can be a big cost saver for everyone.

After building a working demo on the Ethereum Ropsten testnet mid 2020, we decided to test the system through a couple of testnet trading competitions. That was a great learning experience to figure out what could be improved on and to find any bugs in the code. It also meant we had a build a community ahead of mainnet launch.

A strong community is important since dHEDGE is driven by a DAO model. The future of the dHEDGE protocol is govern by the community through staking and voting. You can think of dHEDGE as an open-source software protocol. Through our DAO and DHT staking, decentralised governance of the protocol is enabled and it makes is possible for the protocol to evolve over time.

dHEDGE leaderboard

Since a few months, dHEDGE is now live on Ethereum and has seen a fantastic growth since its launch. The first thing you see on dHEDGE is our leaderboard. We think gamification and the social aspects are important. Having a leaderboard means the managers compete for the top position. It’s important to incentivise the right things. Pools on dHEDGE are ranked by a combination of their risk-adjusted metric called Sortino Ratio as well as their Total Value. Manager’s can communicate their thoughts about the market in posts. They can either be open to the public or private. Private posts can only be read by investors in the pool - we think that’s a really cool feature! We hope to improve and enable more social features in the future as this creates stickiness for the platform.

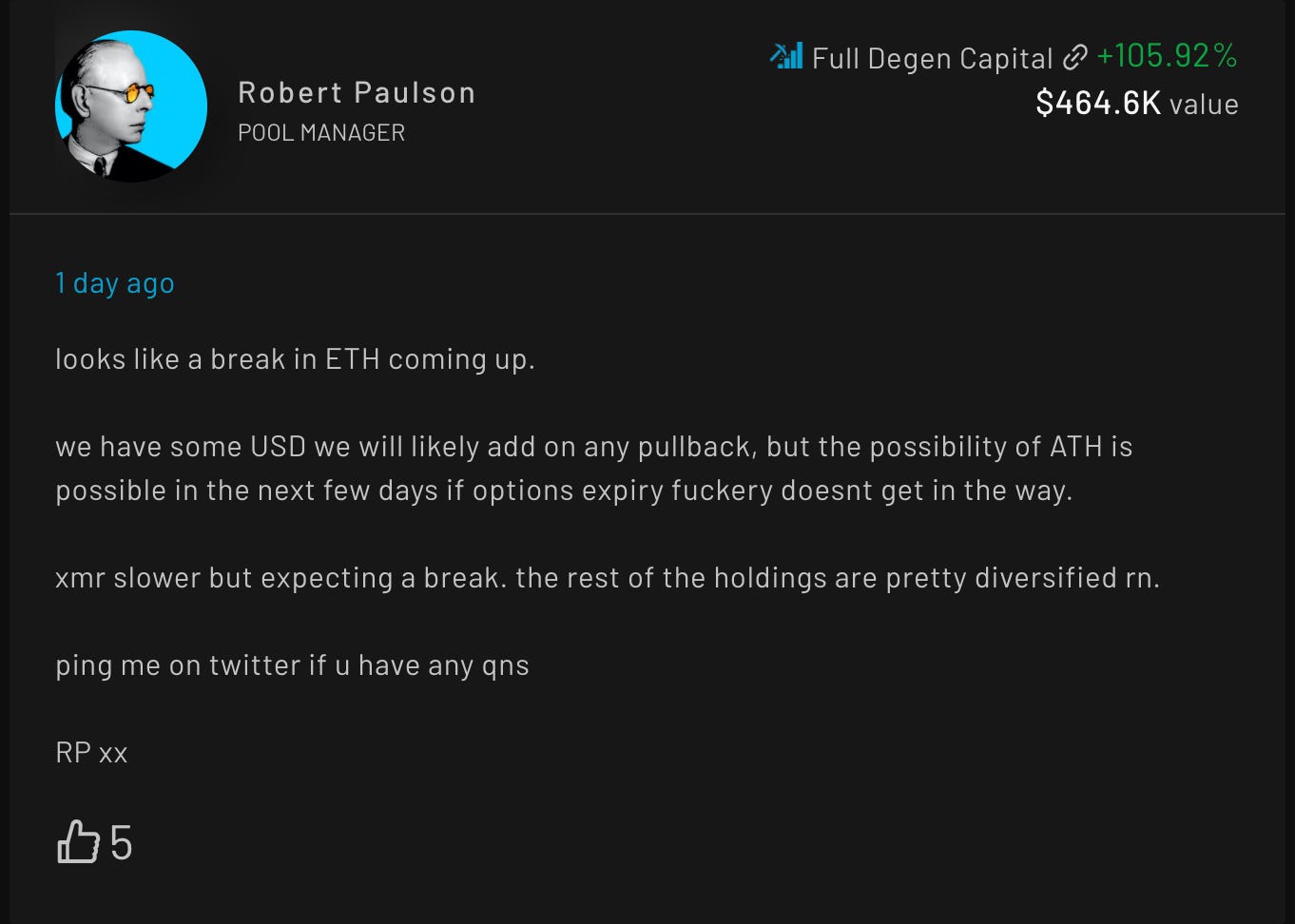

Manager Post

To invest alongside a pool you will need to deposit sUSD which is Synhtetix’s native USD stablecoin. This is the base currency for dHEDGE if you like. When you exit a pool, you receive your share of synths in the pool at the time. These can then be exchanged for sUSD or other crypto assets by the users.

On dHEDGE you can access the strategies of the best managers in the world that have chosen to join the platform. Since all trading is taking place on Ethereum, everything is transparent to the users. In addition, since dHEDGE is non-custodial, the managers can’t ‘run away’ with the funds - they can only rebalance the funds.

We aiming to become the standard decentralized asset management protocol. The traditional asset management industry is gigantic at $100 trillion, so the potential target market is enormous.

An issue with Ethereum is the high gas costs (due to the popularity of Ethereum) and also the time it takes to make transactions. Later this year we are looking to enable dHEDGE on L2 - Optimism which will be a huge accomplishment and great for the user experience of dHEDGE. That’s definitely very high on our list as a lot of the feedback we get and in DeFi in general is about the gas costs and the time it takes to transact.

In 2020 built a lot of the foundation to be able to continue the fast growth and continue to ship at a rapid speed in the year ahead.

Below are some links if you like to learn more about dHEDGE:

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.