Checking DeFi On-Chain Metrics - TVL, Revenue, Fees, etc.

Checking the most important on-chain stats for DeFi protocols during the bear trend.

Hey DEFI TIMES community,

On-chain activity has been declining - Gas prices are super low at the moment! Does that mean that people are not interested in using DeFi anymore?

While interest could be declining, it seems natural to check the health of the DeFi ecosystem.

How is the TVL doing? Is it correlated to the price movement?

A natural conclusion would be that its are struggling as well.

But it seems like… we are thriving as always!

Let’s check the most important on-chain stats for DeFi protocols during this bear trend.

Subscribe to our newsletter to level up your crypto game!

Checking DeFi On-Chain Metrics - TVL, Revenue, Fees, etc.

Total Value Locked (TVL)

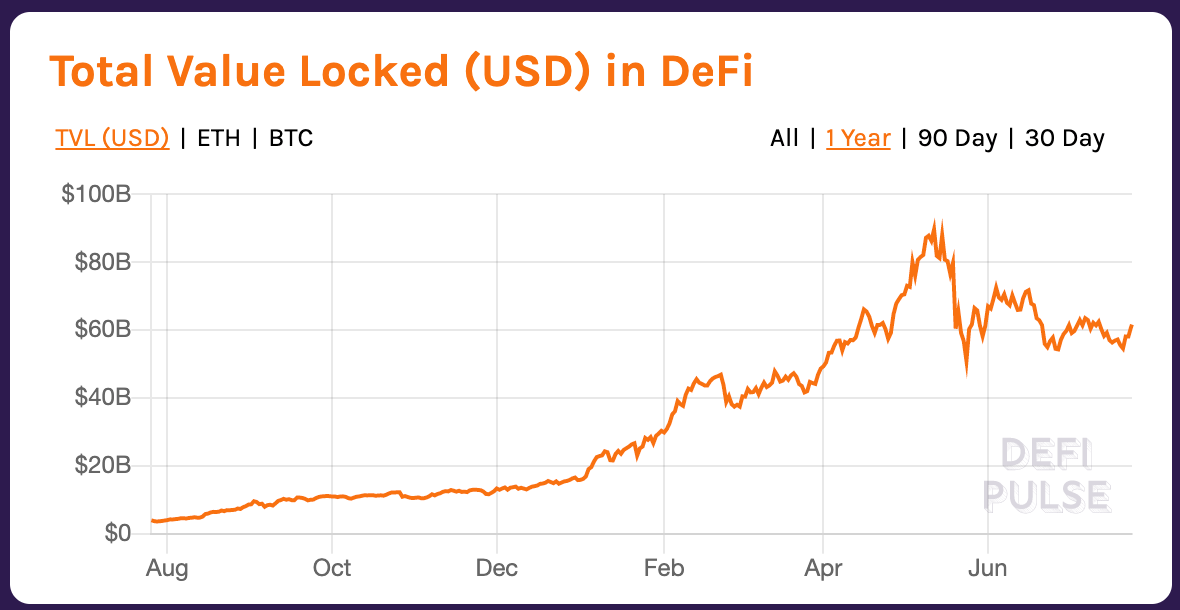

The TVL defines how much funds have been deposited into smart contracts and it’s one of the most fundamental on-chain metrics to determine the health of the DeFi ecosystem. To put it simply, the TVL represents the number of funds that users currently stake in a specific protocol.

If protocols are not actually used, they are worthless. And tracking how much money is deposited into all DeFi protocols combined gives us a great overview of whether our ecosystem is healthy. TVL means usage, usage means fees, fees mean value! That’s why the TVL growth will ultimately impact the token price. The higher the TVL, the more fees are accrued. The TVL is probably the single most important metric to determine the health of a DeFi protocol because it impacts all other metrics in some kind of way. In the end, the TVL impacts fees, revenue, P/E ratio, and so on.

We want the TVL to grow as much as possible. The more, the better - it’s as simple as that!

The current TVL is sitting at $60 billion, which is quite a setback from the all-time high in May ($90 billion). However, this is not the full picture. If you only look at the TVL in Dollar terms, you might think that we are suffering.

But measuring the TVL in Dollars is not very accurate. The best way to track it is in ETH terms. ETH is the native currency on Ethereum!

If you track the TVL in ETH, you notice that things actually look different. While the TVL in Dollar terms suggests that usage went down by 32% the TVL in ETH terms suggests that it only decreased by 13%.

It’s only a matter of perspective!

DeFi Revenue

Before DeFi emerged, tokens were only used as a utility inside a particular ecosystem. With DeFi however, tokens are now cash flow producing assets, which we can value in a similar way as stocks (P/E Ratio, annual revenue, etc.).

DeFi protocols generate revenue by taking a cut of any cash flow on-chain, which is directed towards building up reserves for the protocol. For example, Compound takes a cut of the interest the lenders earn. Compound can then use these reserves to incentivize participants to bring even more value to the protocol (Liquidity Providing, Borrowing, etc.).

That means that two factors influence any protocol’s revenue:

On-chain cash flow of a particular protocol

Reserve factor, which is the cut that protocols are taking from the cash-flow

In the case of Ethereum, the revenue is determined by the total amount of fees, which are mostly burned (after August 4).

On-chain revenue is extremely important because it incentivizes participants to add value. For example, the protocol can distribute part of the revenue to the LPs in order for them to have an incentive to provide liquidity in the first place.

The revenue can also be issued to the token holders turning the native token into a capital asset.

Now, let’s take a look at the largest revenue-generating protocols in crypto.

As you can see, Ethereum is number one in terms of fees. You can take a look at all the other ones yourself, but there is one protocol I’d like to highlight here: Axie Infinity.

Axie is an extremely popular game on Ethereum, which has attracted thousands of non-crypto people during the last few months.

And now, Axie is generating more fees than Uniswap?!

Axie is one of the best examples of a protocol that has grown throughout the bear trend by simply not depending on market cycles. In fact, they have killed it in terms of usage and price during the last few weeks.

Axie Infinity is the ultimate proof that people are still using Ethereum. Why? Because it’s fun! We now have a thriving ecosystem of independent protocols that attract a large number of people (even-non crypto native people).

And as prices are catching up again… this might only get better with time!

Check out our friends from crypto-careers.com!

If you are interested to join the crypto industry full time, now might be a great time to do so!

Find us on:

DISCLAIMER: All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.