Cake DeFi - How to Generate Passive Income

Hey DEFI TIMES community,

Have you ever run a full node to stake your coins? It is reasonable to assume that most of you haven't, especially if you are new to the crypto space. It is a lot of complicated work, and most people don't have the time and energy to stake their coins.

But this is a pity. By staking your coins, you secure the network and, ultimately, make your coins more valuable. You even receive staking rewards as compensation for locking up your coins.

That's why we need ways to stake our coins with as little effort as possible. We at DEFI TIMES are always searching for projects that simplify the UX in the crypto space.

Today, we would like to introduce such a project to you: Cake DeFi!

Let's dive straight into it!

Subscribe to our newsletter to level up your crypto game!

What is Cake DeFi?

Julian Hosp and U-Zyn Chua founded Cake DeFi, intending to generate cash flow with your crypto assets. There are two ways to achieve this on the Cake DeFi platform:

1) Pool Masternode Staking and

2) Lapis services.

Cake focuses on complete transparency for its users. Each user can verify the rewards anytime. There is no need to trust the company behind it because you always know where your funds are. Lots of other companies claim, for example, to be staking but don't do it in reality.

The user experience is straightforward, so even people with no prior crypto experience can easily understand how the service works (more about this later). Setting up a node has always been difficult for regular users because there are too many things to consider: How do I ensure my node stays online all the time? How many coins are required to stake? With Cake, you do not need to worry about these questions anymore. You don't need to ask for permission if you want to enter or leave a pool. Just visit their website and use their interface to achieve your goal.

There's also a cool feature called auto compounding. If Cake has your permission, every single reward will be used to generate additional revenue. Albert Einstein famously said that compound interest is the most powerful force in the universe. Why not use it to your advantage now?

It's important to note that even though Cake is a custodial service, you do not need to worry about losing your coins. The coin storage computers are not connected to any online services. Only the executive team can access the storage, and if they become unreachable, the keys can be recovered by trusted individuals.

1) Lapis Service

Now, I will explain how simple it is to generate cash flow on your bitcoins (or any other cryptocurrency accepted by Cake).

Of course, you should visit the Cake interface and sign up. You have to fill out a quick KYC questionaire, but it doesn't even take 24 hours to verify. If you are ready, click on the top right on your Cake interface.

In this way, you can view your portfolio on the Cake platform. Now click on the asset you want to deposit. I chose Bitcoin.

You can see the Bitcoin address you have to send your BTC to. Wait a few minutes, and you are good to go!

Now click on the Lapis section and choose the asset you deposited earlier. You will see this interface:

Choose the amount of BTC you want to generate cash flow with.

You can only lend your BTC in batches, which means you can only lend them for a specific timeframe. In this case, I will lock my BTC from December 4th until January 1st, 2021. After that, I chose to compound my BTC upon maturity automatically. Click on "enter", and you will see your batch confirmed.

That's how easy it is to generate cash flow with your BTC on Cake DeFi.

2) Pool Masternode Staking

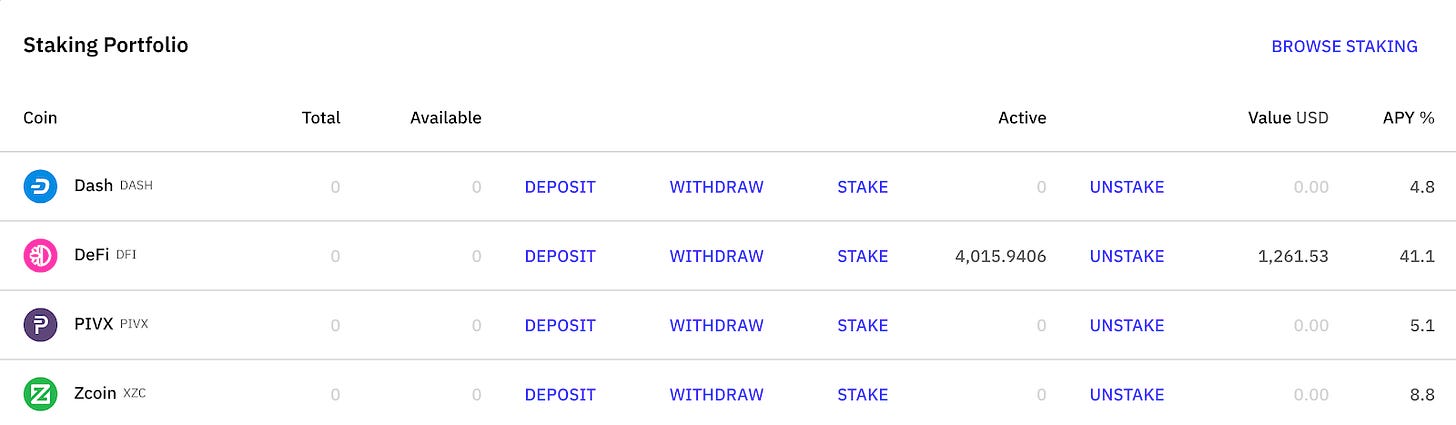

There are several coins you can stake on Cake, including DFI, Dash, Pivx, and Zcoin. I decided to stake DFI for this tutorial. Again, click on your Cake portfolio, choose the asset you want to stake, and send any amount to the shown address. I decided to stake approximately 4015 of my DFI.

Enter the amount of DFI you want to stake, click on "BUY," and that's it. Congratulations, you just staked your first DFI!

If you look at your portfolio afterward, you will see that they are unavailable for withdrawal as they generate yield for you. As of now, the est. APY is 41.1%. Pretty neat, right?

As a last note, please make sure to enable 2-Factor-Authentication. Protecting your coins should always be your number one priority. Cake cannot help when your funds are lost. Blockchains cannot be backrolled.

Conclusion

Cake DeFi is an easy way to stake your coins. The user experience is effortless as it takes a few clicks to achieve your goal on the platform.

Cake offers a custodial way of staking, which means that the company controls the private keys for you. Remember: using custodial services is not wrong, even though many influential people in the crypto space claim this. Companies know how to store private keys. Especially if you are a beginner, you should use those services to minimize your risk.

Also, consider what happens in the long run. As the masses enter the crypto space, they will demand bank-like services. Can you imagine your uncle memorizing his private keys and saving his ETH on Aave? No, he will probably use crypto banks that will do it for him.

That's where the future is heading. We will need a combination of decentralized protocols and centralized companies to reach mass adoption.

Cake is taking us one step further in this direction.

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.