Building the Uniswap of the Polkadot Ecosystem - Polkastarter

Hey DEFI TIMES community,

In DeFi summer 2020, decentralized exchanges (DEXs) turned out to be irreplaceable in the DeFi ecosystem. Uniswap quickly became the dominant DEX in the space.

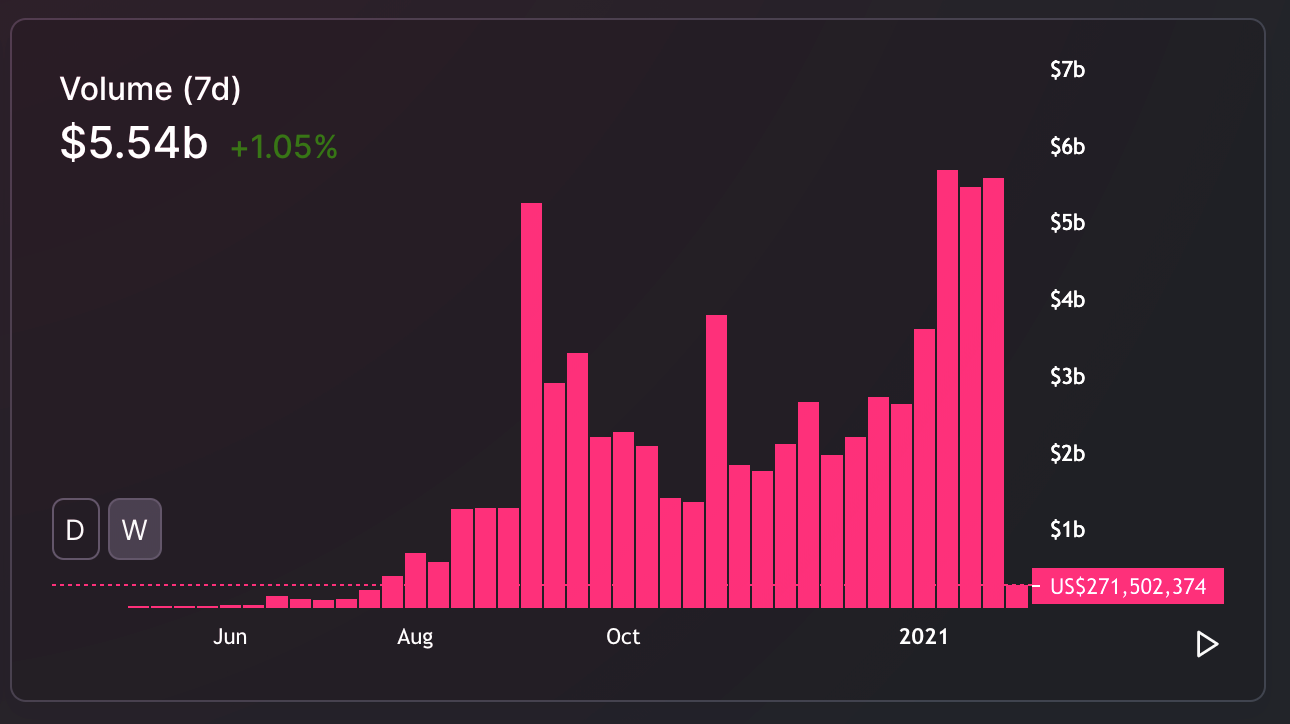

Source: https://duneanalytics.com/hagaetc/dex-metrics

As more and more projects used the momentum to launch their tokens, IDOs (Initial Dex Offerings) moved into the mainstream. IDOs are token offerings that are executed via a decentralized exchange.

This concept was first introduced by popular centralized exchanges, such as Binance. In 2019, IEOs were very popular. But the hype vanished because the process was too centralized.

IDOs are the decentralized counterpart to IEOs. However, IDOs have drawbacks as well. For example, transactions are slow and expensive when they are done via DEXs. Uniswap users often pay up to $20 per transaction to buy or sell a token.

Also, projects must provide liquidity on both the token for sale and a quote currency (ETH) on Uniswap. Otherwise, they can't issue their token in the first place. Depending on the liquidity ratio, the token price changes quickly. So, projects cannot issue their tokes at a fixed rate.

However, DeFi users are tired of these problems. They demand cheaper transactions, faster swap, and interoperability between blockchains.

Polkastarter is a project that aims to solve these issues.

Let's get started!

Subscribe to our newsletter to level up your crypto game!

How Polkastarter works

Polkastarter seeks to become the first interoperable DEX. While launching on Moonbeam in Q1 this year, it is still located on the Ethereum blockchain.

Moonbeam will be an EVM-compatible parachain of Polkadot, which is why the team doesn't have to rewrite the source code of Polkastarter to switch to Moonbeam. The team can develop the MVP on Ethereum without any complications.

The core features of Polkastarter are fixed-swap pools and interoperability.

Fixed Swap Pools

Fixed-rate swaps solve three main problems:

1. Lack of control mechanism: rug pulls or unfair token issuance

2. Private investors dump their tokens on

3. High token issuance costs

Every time you buy a newly issued token on Uniswap, you change the token's liquidity ratio, which means fewer tokens are available for sale. When the token supply decreases, the token price increases.

That's why token sales on Uniswap are complicated to conduct.When many investors try to buy a particular token at the same time, prices skyrocket. Some investors might purchase the tokens at a much higher price even though they bought just a few minutes later than the majority.

Polkastarter's fixed swap pools ensure the same price for every single investor. The process gets much fairer, and also transparency is increased.

Projects can easily calculate how much money they will collect, how many tokens they sold, and investors can make sure that their money will go into the development funds.

Additionally, projects can set custom parameters for the token sale. For example, they can control the maximum investment or the number of investors. Soft- and hard-caps could be hardcoded into the smart contracts.

A lot of different features are possible to ensure a fair token launch.

Interoperability

Polkastarter builds on the Polkadot blockchain. There are two main reasons for this: Scalability and interoperability:

"Popular blockchains such as Bitcoin and Ethereum process anywhere between 7 to 15 transactions per second (TPS). This is extremely slow compared to real-world networks (i.e. credit card networks) which have a speed of 20,000 TPS. Moreover, gas fees can spike to extreme levels in peak periods, making it difficult to scale to mass adoption."

Polkadot can process transactions simultaneously rather than sequentially, which is why the transaction throughput is exceptionally high.

Furthermore, Polkadot allows interoperability with other blockchains, such as Ethereum. Polkadot is the ultimate bet on a diverse future because the blockchain tries to leverage liquidity from other blockchains by connecting every single chain.

Polkastarter uses Polkadot's interoperability to increase liquidity on its pools. For example, ERC-20 tokens can come from Ethereum to Polkadot, which can then be used on the Polkastarter exchange. Polkastarter, therefore, doesn't only profit from the growing Polkadot ecosystem but also the ever-increasing DeFi ecosystem as a whole, no matter the blockchain.

Tokenomics

The native protocol token is called POLS. You can use it in many ways to contribute to the Polkastarter platform.

1. Governance: Token holders can vote on product features, token utility, types of auctions, and they can decide which projects will be featured by Polkastarter

2. Protocol fees: You will pay transaction fees in POLS

3. Staking for pool rewards: Stakers are eligible for staking rewards. If a user holds 5% of all staked POLS, he will receive 5% of all generated fees. Dividends are paid out in 24-hour cycles. You are only allowed to stake if you provide liquidity to Polkastarter pools.

4. Staking for pool access: For high demand pools, access can be limited to top liquidity providers

5. Liquidity mining: Every day, a fixed amount of POLS is distributed to liquidity providers.

Above, you can see the inflation reward schedule. The inflation is pretty high at first but gets lower after some time. After 12 months of its existence, over 80% of all POLS will be distributed.

Conclusion

Polkastarter seeks to be the Uniswap of the Polkadot ecosystem. While the Minimum Viable Product is still on the Ethereum blockchain, it will soon switch to Moonbeam, a Polkadot Parachain.

Moonbeam is EVM compatible, which is why Polkastarter's code doesn't have to be reconfigured.

All in all, the potential of Polkastarter seems endless. If we take a look at the growth of similar projects such as Uniswap, we realize that there's a lot of upside potential for Polkastarter.

Polkastarter could skyrocket similarly. There are very few competitors on Polkadot to be taken seriously. Furthermore, Polkastarter leverages Ethereum based liquidity from the very beginning, why is a big driver for every DeFi project.

Whether or not POLS outperforms other DeFi tokens is yet to be seen. Let's see where it goes.

All information presented above is meant for informational purposes only and should not be treated as financial, legal, or tax advice. This article's content solely reflects the opinion of the writer, who is not a financial advisor.

Do your own research before you purchase cryptocurrencies. Any cryptocurrency can go down in value. Holding cryptocurrencies is risky.